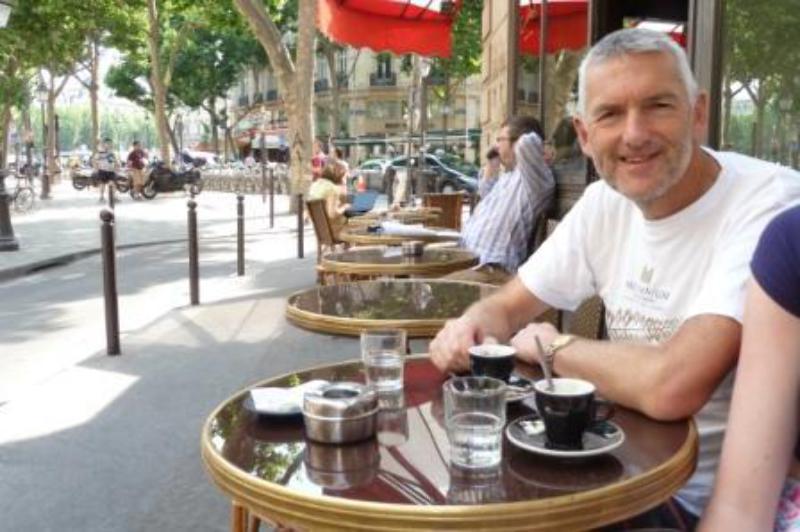

Getting to know...Peter Lee

Peter Lee has had many roles in the financial services industry, including a stint as CEO at the IFA. Now he has joined the ranks of advisers.

Friday, August 7th 2015, 11:23AM  1 Comment

1 Comment

How did you get into the advisory industry?

I’ve had quite a few years doing a range of things in the financial services industry and was at ANZ Bank in an adviser support role, ploughing my way through NCFS. Of course, over the years I’ve got to know some really great people and found I really enjoyed spending time with financial advisers and supporting them. I’d go to IFA meetings simply for the joy of learning new stuff and spending time with advisers. It wasn’t really a big mystery.

You've worked in funds management, run the IFA and have now joined the ranks as a financial planner. What made you become an adviser?

Actually, over the years I’d had a number of people suggest to me that I should become one. I must be a slow learner! In the end it wasn’t one thing but many small things – I realised I really liked advising and helping people and I could see the potential to be a good professional. Last year I had a number of great conversations with a few advisers, and the more I looked the more it seemed a natural and ultimate career step – especially with all the areas I’d been involved in. I’d also spent a lot of time training and helping advisers to be better at their craft – and realised that maybe I should put it all into practice! I’ve also had 20 years of observing good advisers at work and working out what to do, so it wasn’t exactly a step into the unknown. And everyone I talked to was incredibly supportive – thanks guys!

The philosophy of your business is: Build a dream; Leave a legacy; Make a difference. Can you tell me more about that?

I’ve always believed in giving back and making a difference . When I set up as an adviser I decided I wasn’t going to have a bland, take-any-client approach, but find my own ‘ideal clients’. For me it was natural to focus on clients who are like me and also wanted to make a difference in their own way, something that endures – that’s the ‘legacy’ bit. It overlaps with my interest in conservation and probably the idealist within me. Probably it also comes from my days at Guardian Trust, a business that is all about the future.

If there is one thing you would like to change about the financial advice industry, what would it be?

The fact we have an industry and not a profession. It’s still possible for someone to become an RFA or QFE adviser overnight with zero experience and knowledge. You can’t do that in any other profession.

What’s the best advice you have ever received?

Become an adviser! But more particularly, to set my sights high.

Are you in KiwiSaver? If so, what's your investment strategy?

Of course! And I’m very much a long-term, set-and-forget investor, strongly pro-managed funds. I’m not really interested in direct investments and take little notice of share movements and tell my clients the same. And yes – given my interest in ethical funds – I’m in Grosvenor’s ethical KiwiSaver option.

Outside of work what do you do?

Our daughters are at uni but still at home so as a family we wind up doing a few things together still, like camping at a gorgeous bay up north, and the odd holiday. I do have a love of DIY and renovations – most satisfying! But the other things I most love doing are to do with the natural world - I’m an inveterate tramper and walker and can’t resist an opportunity to do a good bit of exploring! Anyone who know me also knows of my passion for a conservation island called Tiritiri Matangi, near Auckland – I’ve been guiding and volunteering there for 25 years and been on their committee for over 20.

What’s one thing people may be surprised to know about you?

In the late 1980s I “dropped out” of financial services to study architecture fulltime for 2 years. If I’d been better at design, I’d probably be doing it now! I still love architecture and have just been in Barcelona visiting some of the buildings of my favourite architect, Antonio Gaudi. His Sagrada Familia church is jaw-droppingly amazing.

If you weren’t in this job what would you be doing?

If Id been any good – architecture! As a second choice – running a conservation tourism project somewhere.

| « Getting to know... Elaine Campbell | LVR restrictions to be reviewed » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

I absolutely agree as product suppliers have always been allowed to distribute their products by whoever can sell. They have never shown the required level of commitment to lift the educational levels of their distributors and this is why it is still regarded as 'an industry'.

With the Trowbridge Report and FSC's interest to lead some reform, there has never been a better time for product suppliers to immediately set improved educational standards but also to recognise those professionals who have already attained their professional qualifications. The AFA Adviser status is not enough.