Traditional balanced funds - return free risk?

If you have a KiwiSaver account or an investment portfolio the likelihood is that you will be invested in some sort of diversified balanced fund. This is the typical investment for an investor who has an average tolerance for risk and is not too close to retirement.

Monday, June 19th 2017, 9:05AM  1 Comment

1 Comment

by Richard Stubbs

The traditional diversified fund approach is the result of the work of Harry Markowitz’s Modern Portfolio Theory, which was developed in the 1950s. It is based on using a broad selection of assets to create a portfolio that maximises the potential return for a specific tolerance for risk, risk being defined as the expected volatility those returns.

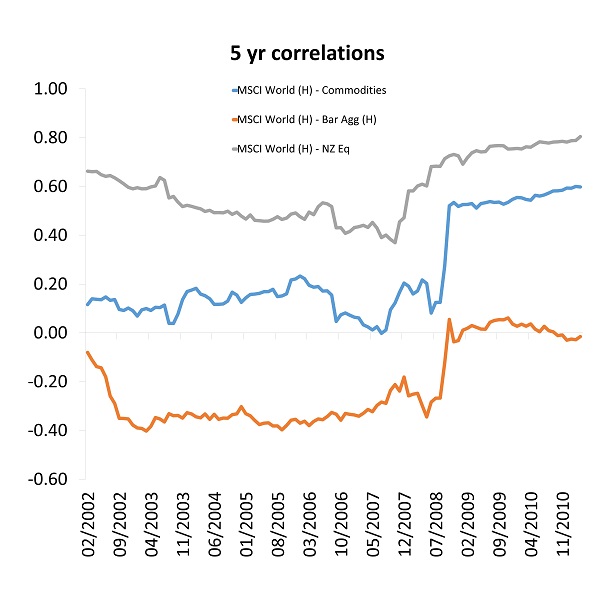

A particularly important set of assumptions is the correlations between asset classes; essentially, how closely the prices of each asset class (equities versus bonds for example) move together. The result should be less volatile returns from a balanced portfolio versus holding just one asset class.

In our opinion, there are two main problems with traditional diversified funds. These are the assumptions around risk and the requirement for these funds to be fully invested at all times.

Risk

Correlations between asset classes often markedly increase in times of crisis, removing the expected benefits of diversification – just when you need it the most. The chart below shows how the correlations of some core asset classes increased significantly during the global financial crisis in 2008.

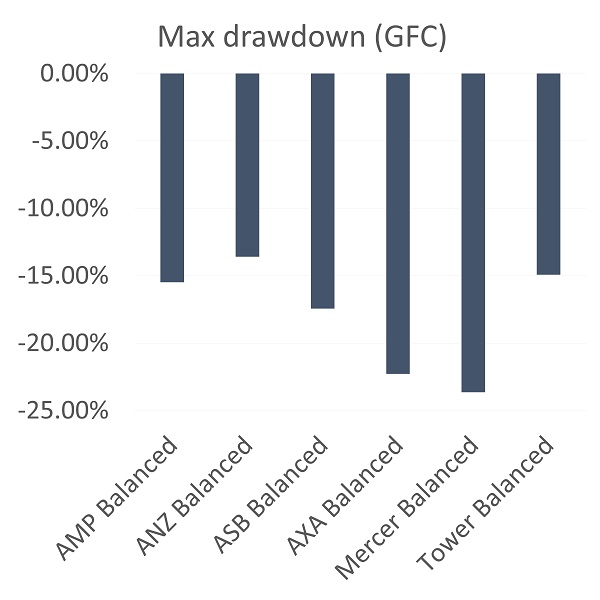

This increase in correlations resulted in balanced funds performing worse than modelled expectations would have suggested during this period. The average 12-month maximum loss for balanced funds of the six default KiwiSaver providers was -18%.

Source: Bloomberg, website KiwiSaver returns

History shows us that the theory behind diversified funds often breaks down during times of financial crisis (often called 'black swan' events) and these events happen more often than economic theory expects them to.

Benchmarking

Traditional active diversified funds do have discretion to move away from passive market indices, but this discretion varies and is often not very high. Often, managers of each asset class are required to be fully invested at all times and their performance is measured against a passive index, so if the index is down but the manager down less, the manager has done a good job.

In our opinion, there is not enough attention given to the risk of black swan events in traditional diversified funds. It can take a long time to financially recover from a big negative year. One common sense fix might be to employ active managers that do not have to be invested if they don't want to be!

We are particularly worried that financial repression and this low interest rate environment has distorted the market to a point that the theory is almost certain not to work during the next economic downturn. Low interest rates have raised prices of most asset classes to, in our opinion, levels that are not sustainable long-term. The equity/bond diversifier that was at least present going into the GFC now simply isn’t there.

The distortions that financial repression is having on some of the passive indices is also disturbing. For example, a commonly used bond index, the Barclays Global Aggregate Bond Index, has substantially more long-dated bonds in it than at any time in its history. That means that index constrained bond portfolios are becoming more sensitive to interest rate changes at a time when interest rates are at all-time lows. In 2000, the index had a yield to maturity of 5.9% and a duration of around five years. Today, it has a yield to maturity of 1.5% and a duration of over seven years. In addition, about a fifth of the investments of that index are in negative yielding bonds! That means that you are guaranteed to get less back than you invested in those bonds if they are held to maturity!

Bill Gross, one of the most well-known and successful global bond managers, regularly notes that given the high prices being paid for most assets one should expect very low returns over the next decade. Other famous investors such as Warren Buffet and Jeremy Grantham have also made similar observations. We cover the case for the New Zealand equity market in our April 2016 commentary "NZ Equity returns – future predictions" and come to a similar conclusion.

If these views are correct, a traditional balanced portfolio is likely to deliver not only a mediocre return over the next ten years, but its path is likely to be very bumpy, enduring some big negative years along the way. To us, that seems like a lot of risk for little return, the very opposite of what Harry Markowitz was aiming for.

Castle Point is launching a balanced fund, the 5 Oceans Fund. The commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a boutique Fund manager which was formed in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims with backing from RCP Holdings Limited and New Zealand Assets Management Limited.

Castle Point is a fully owned subsidiary of Raw Capital Partners (New Zealand) Limited which is part owned by the investment team.

Richard is the co-founder of Castle Point Funds Management. Previously he was Head of Equities for Tower Investments in Auckland.

| « Match racing: NZ PIE funds vs US ETFs | Harbour re-launches income fund » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

Never let it be said that our industry wont catch onto something to suit its own aims then hang on like Grimm Death ignoring things have changed! Me I think balanced (Bland) is for those that "used to be indecisive but now not quite sure" types!