A survival guide for financial adviser licensing

All financial advisory businesses will begin a mandatory licensing process, but do not fear, the FMA comes in peace, John Berry says. In the first of two-part commentary he shares his views on what to expect and how to prepare for change.

Tuesday, November 21st 2017, 6:14AM

by Pathfinder Asset Management

His thoughts apply to each of insurance, investment, mortgage and comprehensive planning advice businesses.

Quick overview of this commentary

There is little information available on licensing of financial advisory businesses. This commentary is based on what is available from MBIE/FMA, plus lessons from the licensing of fund managers and DIMs providers. Fund manager and DIMs licensing is relevant as Section 396 of the Financial Markets Conduct Act sets out the structure for the FMA to grant market licenses. Section 396 has three key components for licensing:

- prescribed eligibility criteria

- directors and senior managers being fit and proper to hold that position

- capability of effectively performing the service

As a boutique fund manager, we faced licensing with the same apprehension many adviser businesses now have. Yes, it took time and energy to get through the process, but we managed to run virtually all of the licensing process ourselves with relatively little money spent on external advisers/consultants. The purpose of this commentary is to get advisers prepping for licensing. This means thinking about the business, its processes and its systems – and, more importantly, how to coherently articulate what the business does.

What are MBIE and the FMA trying to achieve?

The world changed for advisers when the Financial Advisers Act 2008 was enacted. Further significant changes are proposed under the current Financial Services Legislation Amendment Bill. From an advice delivery perspective, the changes are intended to provide flexibility and clarity, such as:

- Current product distinctions (category 1 and category 2) and current advice distinctions (class vs personalised advice) will disappear

- robo advice (ie advice not delivered by a natural person) will be permitted

- the AFA / RFA / QFE classifications will go

- all advisers (not only AFAs) will be subject to the Code of Conduct

- the licensing will be done at a firm level

The last point is important – it will no longer be a regime of licensing/registering individual advisers. Everyone giving financial advice (including robo advice) will need to be operating under a licensed business.

Time line to implementation

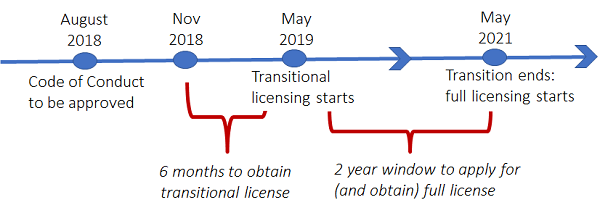

The expectation is that, from May 2019, anyone providing financial advice will need to work for a firm with a transitional license (transitional licenses can be applied for from November 2018 which is three months after when the Code of Conduct is expected to be approved). Existing adviser businesses will have two years to meet the standards and obtain a license.

The transitional licensing gives existing participants two years to meet the required standards. The good news is that MBIE expect transitional licensing to be a simple process – no more than simply notifying the FMA of the firm’s name, list of financial advisers at the firm and description of services provided. Yes, MBIE are indicating a transitional license should be that easy – but a full license will be a higher hurdle.

The implementation timeline does come with one caveat – the new Bill is not on the new Labour government’s 100-day plan. There is market speculation that this could mean a few months' delay, but nothing has been confirmed.

Will licensing be hard for advisers?

MBIE have indicated high level factors that the FMA is likely to take into account with licensing requirements. Essentially, they will be asking “is the adviser business fit for purpose?” There is no single right way to prove this. What is appropriate for one business in terms of infrastructure and process, may be quite different to another – the firm’s structure, resources and risk management must be “right sized” for its operations.

There are two critical points to note from the FMA’s “Quick guide to license applications for small businesses providing DIMs”. It will be very helpful for small adviser businesses if the FMA were to apply these to financial advisory licensing:

- there is flexibility in how businesses meet the minimum standards

- the systems and controls expected in a single-adviser business will be simpler than those expected in a larger or more complex business

Detail in the application: background info

The license application will likely begin at a high level with the FMA looking at:

- The nature and size of the firm (including how many clients it has, business ownership, services/products provided and what policies documents are in place)

- Whether the firm engages financial advisers, nominated representatives or is a sole trader.

The introductory part of the license application should be seen by advisers as an opportunity to clearly articulate what the business does. This will effectively frame the direction of the application and how the FMA views your business. For example, you could include:

- high level description of your business (what is the firm’s philosophy, what is your firm’s value add for clients?)

- overview of why you think your business is sensibly structured. What you are really trying to articulate is why the FMA should see your business as lower risk from a regulatory perspective (this could be because you have a highly structured evidence based process, you use external expert models, you only focus on a certain type of client/product, you aim for full transparency of process with your clients etc).

By the end of the introductory part of the application, the FMA should understand your business. This will make the rest of the application easier for the FMA to follow.

Detail in the application: directors and senior managers being fit and proper

Here the FMA assesses if the people running the business are fit and proper to do so – it essentially covers only those with significant influence on how the business is run. This will likely involve providing a bio of relevant experience and qualifications.

The FMA may also ask how the business ensures that directors and senior managers do not cause detriment to clients or gain an improper advantage. This is easily answered by confirming advisers will comply with the Code of Conduct and act with integrity. There is nothing particularly onerous here.

Detail in the application: capability to perform the service

The capability section will likely take the bulk of time preparing an application. We can break it into three parts: (1) team capability (2) operational infrastructure and (3) governance structure.

First, for the team’s skill and capability you will need to address:

- Who is your team and why do they have the right skills and experience?

- How are roles, responsibilities and accountabilities defined and shared?

- What is the process for recruiting new staff?

- How do you access external advice if the management team capability doesn’t have an area of expertise? (This may be compliance, AML, legal, investment research or tax help you need. Simply identify how you know when you need external help and in general terms how you would go about finding and engaging an external specialist).

Secondly, what operational infrastructure does the business have:

- What is the process for on-boarding new clients?

- How do you know what your client wants (i.e. what the client objectives are)?

- How do you select product – what is the decision making process?

- How do you identify and manage conflicts of interest?

- How do you monitor and report to clients?

- If you outsource any functions (including custody), how do you know you can have confidence in that third party and how do you monitor them?

- Do you have a business continuity plan?

- Does the business have appropriate financial resources?

- How do you identify and mitigate business risks? (map the business risks in a table)

- Do you have indemnity insurance (and why do you think the cover level is appropriate for your business?)

- How do you advertise?

- How do you identify material breaches of your license obligations and report these to the FMA?

- How do you deal with client complaints?

- What IT systems do you have and how do you decide they are fit for purpose?

Thirdly, governance of the business:

- Do you have a board and, if so, how often do they meet to consider high level issues in relation to the business? (Note: the DIMs license application did not require sole practitioners to set up a formal board with external directors – but it did require the sole director to have a process for considering high level governance and risk issues. If you are a sole practitioner, have a policy to set time aside each week or month to do this).

- How does the board access the information it needs relating to the business? What is the quality of information reported to the Board?

- How do you test compliance with your policies and procedures?

Will licensing be impossible for small adviser businesses?

Short answer – no, it will not be impossible. It has been clear in market services licensing by the FMA (for fund managers and DIMs providers) that the requirements are “right sized” for each business and there is flexibility on how standards are met. There are four things adviser businesses should be thinking about now:

- Understand every aspect of your business and be ready to coherently articulate this in your license application

- Think about why the people in the business have the right skills (you can be a sole trader, just be ready to demonstrate you have the skills needed)

- Have business infrastructure that is appropriate for your business size and sufficient to protect client interests.

- Have structure and process around the business to deliver consistent outcomes for clients – a common-sense process that has been thought through will make the cut. By contrast, a “seat of the pants” client process that runs purely on intuition (or worse, guesswork) absolutely will not cut it.

Next month, we will focus on some key parts of licensing (such as compliance testing) and also practical tips to make the licensing process less stressful. Licensing is coming – there is no need to fear it. As long as you can tell a story mapping out your business, and your systems are fit for purpose, you will get a financial advisory license.

John Berry is co-founder and CEO of Pathfinder Asset Management Limited, an independent director of Punakaiki Fund Limited and a member of the Code Working Group. This commentary contains views of John Berry writing as CEO of Pathfinder. His views are formed and given independently of the Code Working Group.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « When price and value diverge | Super cheap Boom » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |