Conditions ripe for rent rises

Conditions look set for rents to rise over the coming year, despite overall downward pressure on house prices, according to ANZ’s Property Gauges.

Tuesday, May 4th 2010, 12:00AM  1 Comment

1 Comment

by Maddy Milicich

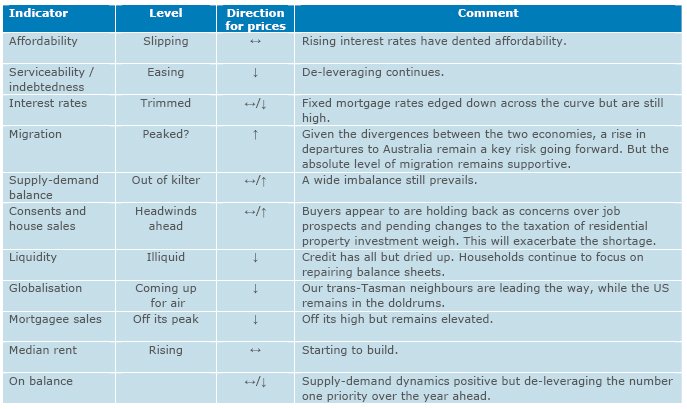

The 10 gauges are used to measure the state of the property market for signs of emerging changes plus the impact each gauge will have on house prices and the overall balance of April's measures aren't too flash.

Of the April indicators, one shows a positive direction for house prices, two are neutral with a positive bias, two remain neutral, one is neutral with a negative bias and four are likely to have a direct negative impact on prices.

Rents will be the ray of hope this coming year for investors, with conditions set for them to start building. The supply-demand balance remains out of kilter and continuing migration, the one positive indicator in April, support rental rises.

Migration levels remain strong, despite having dropped significantly and are currently sitting at the lowest level since the beginning of 2009. ANZ comments that rising departures to Australia remains a key risk threatening migration to New Zealand this year, but the overall level remains supportive to the property market.

The low levels of consents and house sales will also see pressure for demand remain relatively significant, exacerbating the shortage in the market.

Affordability for new entrants into the housing market has been dented by rising interest rates, which will counteract the affect dropping prices may have had on the market this year.

The negative indicators for price are liquidity, with credit having all but dried up; globalisation, which looks at the relative property price movements between New Zealand, the US, UK and Australia; mortgagee sales, despite having come off their peak remain elevated, and; serviceability/indebtedness (interest payments relative to income and the level of debt relative to income), as de-leveraging continues.

| « Momentum building in house market, according to ANZ | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Comments from our readers

Commenting is closed

| Printable version | Email to a friend |

I certainly would not invest in property in the near future.adroitly