TOP tenancy policy ignores rental realities

Gareth Morgan’s Opportunities Party (TOP) wants to make it very difficult to evict tenants – but that could have a detrimental effect on the market, landlord advocates warn.

Monday, August 7th 2017, 12:20PM  2 Comments

2 Comments

by Miriam Bell

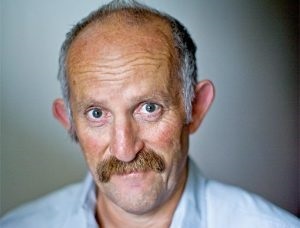

TOP leader Gareth Morgan

TOP released its tenancy policy this morning and it wants to introduce the German rental market model.

That means changing current tenancy laws so that the default standard lease makes it far easier for a tenant to remain in a rental property long-term.

To achieve this, the reasons a landlord could evict a tenant would be restricted to non-payment of rent or property damage.

Additionally, rental properties would have to be sold with existing tenants in residence.

Market rents would still apply, but regulations to prevent existing tenants being priced out of the rental properties they live in would be introduced.

TOP leader Gareth Morgan said this would help develop a rental market where tenants have greater rights and long-term security.

“It means the modest and low incomed will no longer need to climb the mountain of home ownership in order to create a stable long-term home for themselves and their families.”

He said that solving New Zealand’s most pressing social issue - the housing crisis - isn’t just about increased building or decreased prices.

"It’s about the way a civilised society should regard residential property as a social asset for an entire nation rather than a financial asset for a select few".

TOP’s plans for the rental market are not new: they were a feature of the party’s housing policy released earlier this year.

But the latest tenancy details are more specific and emphasise the intent to revamp New Zealand’s rental market to resemble the German market.

While Morgan believes this model will reduce housing inequity, landlord advocates are warning that instituting the policy could have a detrimental effect on the market.

NZ Property Investors Federation executive officer Andrew King said the reality of the New Zealand market mean there is a huge risk the policy would lead to a reduction in rental accommodation.

Most New Zealand landlords are not professional landlords, rather around 75% of people who own rental properties only own one rental property, he said.

“That means that any policy which restricts people from exerting ownership rights over their own property – like removing their ability to evict tenants when selling a property – will simply lead to more people leaving their properties untenanted.

“At this point in time, New Zealand desperately needs more rental properties but, under TOP’s policy, we would end up with less.”

King added that while growing numbers of landlords and tenants do want fixed, longer term leases, the bulk of them still prefer periodic tenancies.

“In our experience, if you give tenants the choice most prefer flexibility over security of tenure.

“People like the flexibility of being able to move if their circumstances change suddenly, they like not being tied down.”

Read more:

Give tenants greater security – TOP

Political support for longer term leases

| « Insulation, heating improvement needed | Upswing in Auckland rental yields » |

Special Offers

Comments from our readers

Within the German model, when Tenants rent a property they then pay for, supply and maintain their own floorcoverings, kitchen and bathroom appliances, light fittings and all the other fixtures within the apartment.

However, under the NZ Residential Tenancies Act the Landlord must provide, maintain and repair these items.

As well as their rent, German tenants also directly pay any ongoing costs of the property such as insurance and rates.

When the tenancy finally does end, the tenant is then obligated to return the property back to the condition as at the day they took possession. There is absolutely no allowance for 'fair wear and tear'.

As our law currently stands, this is not an option that can be made available in New Zealand.

The Auckland Property Investors Association has formulated a proposal that would allow Landlords to offer Tenants the option of similar long-term tenancies, but this would require changes to the Tenancies Act, and so far there has been little political interest in making these changes

Sign In to add your comment

| Printable version | Email to a friend |