Housing market to cool? Yeah Right

While MPs, bureaucrats, and others are calling for the housing market to be cooled, Kiwis don't think anything will happen.

Monday, November 30th 2020, 6:17AM  1 Comment

1 Comment

Ongoing talk on ways to cool the blistering housing market isn’t resonating with Kiwis according to the latest ASB Housing Confidence Survey, with expectations for New Zealand house prices now sitting at a record high.

ASB senior economist Mike Jones says, “after a brief dip during lockdown, price expectations have spiked. In October a net 67% of people expected house prices to keep rising over the coming year – the highest month in the 24-year history of the survey.”

Jones says: “Rightly or wrongly, these results suggest housing is increasingly being perceived as a ‘one-way bet’."

He says the Reserve Bank's move to bring back LVR restrictions back and the roll-back of some other policy supports, "promise to take a little heat out of what may otherwise have been a summer scorcher,” Jones says.

For the three months to October, net 45% of respondents say they expect house prices to continue rising - a marked increase from the net 9% expecting a fall in the second quarter of the year.

Jones says the shift is another indicator that New Zealand’s Covid-19 economic recovery is progressing better than initially expected.

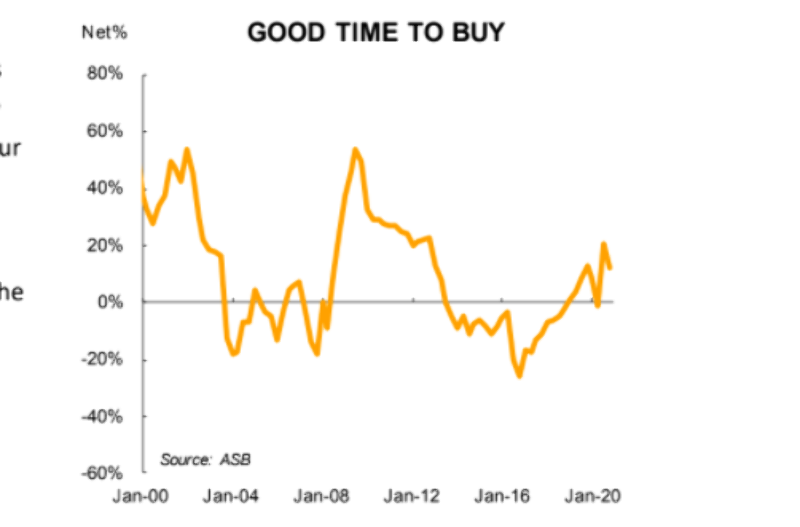

The market pendulum has swung again in the latest quarter, with a net 12% of people seeing now as a good time to buy, down from net 21% in the previous quarter.

Jones says, “this fall might seem at odds with the various supports in play, including mortgage rates at record lows, the earlier removal of LVR restrictions and extension of the mortgage holiday scheme.”

But he says affordability appears to be the main driver of the shift in buyer perceptions.

“We tend to observe a pretty strong inverse relationship between the level of house price inflation and perceptions of whether it’s a good time to buy, and this has shown up in our survey via a steep drop in buyer sentiment. Certainly, affordability is under pressure.”

“If our forecasts prove correct, the pendulum looks set to swing even more in favour of sellers over coming quarters. Mortgage rates are expected to fall further and we expect the housing boom to keep chugging through to at least mid-2021.”

“Affordability metrics are already close to record highs and look set to worsen further. It is now clearly a sellers’ market,” Jones says.

Jones says people are expecting interest rates to fall further. “We think one and two-year fixed mortgage rates will ultimately move closer to 2% than their current roughly 2.5% levels. That’s even without the RBNZ having to resort to negative interest rates, which we no longer see as likely.

“In other words, we see further support for house prices, and housing confidence, ahead,” Jones says.

| « Housing crisis needs building surge | Bank questions why investor confidence not higher » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

I read into parts of this article as supporting my letter on Thursday 26 November 2020 which anyone can read if they missed it.....or read again to refresh their memory?

Market sentiment has virtually halved (down from 21% to 12%)

A point to note right now is the large household debt situation which sets the future mode for when interest rates do rise, unless you are the eternal-optimist type who does not believe in yin yang........or what goes up, must go down, & vice versa

People have increased the term (& amount) of their mortgages and have extracted out some equity to buy stuff.

This "stuff" is typically what I have referred to as "bad debt"

Bad debt is that which is taken on by buying depreciating assets....such as cars, and boats .....and travel and so on.

So yes, there is still some perceived growth likely in residential property, however, when you are so far into a growth cycle you need to assess whether that cycle is nearing it's "uppermost" stage or it's "lowermost" stage.

Then you act accordingly....with your gut feel.....nothing too technical required at all.

And hold back too much listening to those who have a "barrow to push."

For those of you who wish to read (or re-read) my letter of 26 Nov 2020 under the editorial titled as follows and as can be seen at the bottom of this page...

Evidence mounts for NZ property market rebound

Inside my letter there is my prediction set in print (& now endorsed within the current above editorial), in which I claim that the fall is set to occur after mid/later next year (2021).

So yes, if you want to take the risk that there may be say six months or so of growth, and you feel you can pick the day of the fall, then go ahead and grab some growth, but keep a very good eye on each day.

Because remember, that when not so many people are buying as there are "sellers", the supply & demand equation sets the price you are likely to achieve.

Ok, and do you think that houses and land are likely to be re-introduced into the CPI ?

That would result in the Reserve Bank breaking the law....seriously.

However, that may also be a remedy to help curb the wildly runaway house price increases of more recent times, and would therefore help save tens of thousands of "ordinary" house-owners from a rather painful financial disaster in their lives as a result of a greed-driven craze.......mostly & simply without the use of their "gut-feeling?"

As I always say "time will tell."