Confidence up but wealth gap grows

New Zealanders’ perceptions of wealth, investment and material well-being has seen a major rebound since June 2020 with a significant reduction in the number of Kiwis struggling to make ends meet.

Wednesday, July 14th 2021, 6:49AM

by Matthew Martin

The 2021 Kiwi Wealth State of the Investor Nation Report was released this morning and shows while the tide is rising for many there are pockets of serious concern – primarily among those with few or no assets.

The survey results confirm Kiwis' financial confidence is on the rise after the Financial Markets Authority released its annual Investor Confidence Report for 2021 last week.

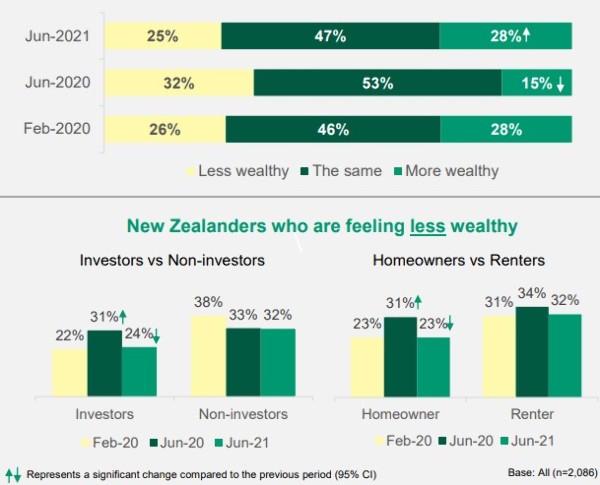

The Kiwi Wealth survey found that more than 25% of New Zealanders feel more wealthy than they did 12 months ago, 70% felt confident about the economy (up 9% on last year) and the number of people who struggle to make ends meet has halved since February 2020 and is now 4% of the population.

In a specific measure of the relationship between wealth and mood, those who have enough money to "do all the things they want" are three times more likely to be happy compared to those who are struggling to make ends meet.

Kiwi Wealth acting chief executive Rhiannon McKinnon says the latest survey report is great for those with assets.

"But it does indicate the disparity in how New Zealanders are experiencing the second year of Covid and how they are feeling about and dealing with their finances in this new economic environment.

"There is plenty of opportunity but inequitable access means there is a lot of work to be done to bridge the wealth gap, both in creation and education and with a particular focus on women."

McKinnon says to some degree the gender-based access issues are being addressed and it would be inaccurate to conclude from this study that women are far behind in practical terms.

"But certainly in terms of perception and confidence and bringing everyone to the investment table, we are still working towards true equality, and our mission is very clear.”

Other key findings to come out of the report were:

- 53% of Kiwis feel confident about global financial markets – up 12% compared to June 2020.

- The proportion of respondents who said they are just managing to get by (23%) or are struggling to make ends meet (4%) has dropped from June 2020 (26% and 7% respectively).

- Key barriers preventing Kiwis from investing in shares in companies, ETFs and managed funds are they don’t know enough about it or how to do it (38%), indicating an education gap in investor knowledge with 32% saying it felt too risky.

- 30% of Kiwis have money invested in shares. Up from 20% in April 2019 with online share trading platforms driving the change.

- 25% made changes in the last 12 months, 51% of those increased the amount in their investments and 33% changed to different asset classes.

- The most popular asset classes remain KiwiSaver (66%), savings accounts (62%), term deposits (30%) and shares in companies (30%).

- Fewer females have savings/assets compared to males. Females are also significantly less likely to be happy in their lives and are significantly more likely to be stressed about their ability to retire.

Kiwi Wealth retail and product general manager Melissa Vasta says the report is a useful yardstick and informs work with government, the community and fellow businesses on collaborative programmes to help address the wealth gap.

"KiwiSaver is part of the solution along with managed funds and Hatch, which has a low barrier to entry and is a well-designed education tool as well as an investor platform.

“We have accounts of people who have amassed a deposit for a house by investing in Hatch and managed funds, so we know, depending on people’s long-term view and risk appetite, there is scope for investing to materially change lives."

Vasta says they are doing everything in their power to bring Kiwis into the investor class, demystify investing and present solutions that make wealth creation accessible.

Perceptive conducted an online survey of 2,086 New Zealanders over the age of 18 that was weighted to Statistics New Zealand census data to achieve a nationally representative sample. The survey was held between May 27 and June 15, 2021.

| « Ending a 40-year career - the true cost of a FADC decision | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |