Kiwi investors leading the Responsible Investment charge

New Zealand is fast becoming a world leader in responsible investing with responsible investment assets growing at twice the pace of other managed investments.

Wednesday, September 8th 2021, 12:39PM  1 Comment

1 Comment

According to a new Responsible Investment Association Australasia (RIAA) report - Responsible Investment Benchmark Report Aotearoa New Zealand 2021 - the market for responsible investments in New Zealand has jumped to $142 billion of assets under management (AUM) in 2020, up 28% from $111 billion in 2019.

Responsible investment assets are growing at more than twice the rate of overall professionally managed investments with the proportion of funds now managed with leading practice responsible investment growing to 43% in 2020.

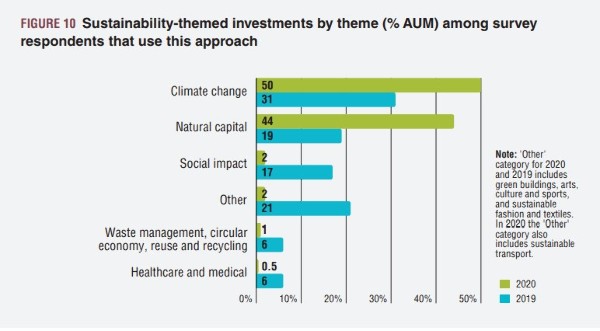

The 2021 report reviewed the investment practices of 47 financial institutions and found sustainability-themed investments have increased more than 15-fold since 2019 to $21.7 billion AUM with investment in climate change and natural capital-related themes making up the vast majority (94%) of these investments.

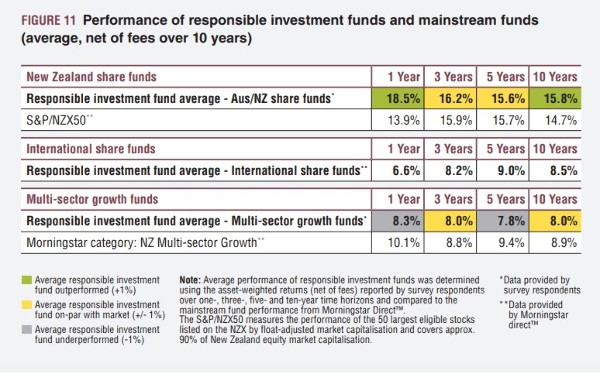

The performance of responsible investment funds compared to mainstream funds (average, net of fees over 10 years) is also encouraging with New Zealand share funds returning 15.8% compared to an S&P/NZX50 average return of 14.7%.

RIAA policy and standards executive Nicolette Boele says the trend suggests the quality of practice in New Zealand is pulling ahead of the Australian marketplace, where only a quarter of investment managers are engaging in leading practice responsible investment.

“Meanwhile we are seeing those investment managers with ineffective responsible investment policies and poor processes being left behind as the capital moves out."

Boele says the shift of capital is being fuelled by changing consumer expectations, increasing regulation, strong financial performance and the rising materiality of different social and environmental issues - from climate change to racial inequity.

“This is an industry in transition. There are rapid developments taking place across countries, regions and markets that are resetting expectations of both companies and investment managers.

"New standards and regulations are moving the industry towards leading standards of practice that contribute measurably to a more sustainable world."

New Zealand is emerging as a leader in this regard, says Boele.

“The Sustainable Finance Forum’s Roadmap, and the recently launched Centre for Sustainable Finance, will also influence how well New Zealand aligns capital with the long term objectives of the country.

“A key area for improvement for New Zealand responsible investors, and investment managers more generally, is in the specific allocation of capital to target sustainability outcomes.

"Increasingly, responsible investment is being defined not just by the strategies involved, but by the short and long term social and environmental outcomes that investors are targeting and generating through their responsible investment approaches."

KPMG head of ESG and responsible investment Mark Spicer says promises and 'ESG claims' made by investment managers are coming under increased scrutiny.

"With regulation on sustainable investment on the rise both in New Zealand and globally, investors face increasing risks from legal action if claims made about their responsible investment products are not accurate."

He says there is room for improvement in terms of fund transparency with the report highlighting that 83% of responsible investment managers are publically disclosing their responsible investment policy and 49% disclosing full fund holdings.

"Climate change is front of mind for both the public and responsible investment managers," Spicer says.

"But negative screening approaches and the expectations of consumers don’t always align. For example, after fossil fuels, consumers most seek products that screen for human rights abuses and animal cruelty, while responsible investment managers focus on excluding tobacco, and weapons and firearms."

| « Trusted Adviser status defended after FoxPlan censure | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

As for some organisations making embellished RI claims, I did love Rob Campbell's recent quote: "ESG is like MSG, it can sometimes change the flavour but never the food."