NZ shares slightly lower with US inflation data

New Zealand shares were mixed, with the benchmark equity index closing mildly lower in tandem with offshore markets.

Wednesday, September 15th 2021, 7:09PM

by BusinessDesk

Overnight US inflation data was softer than expected, with the headline consumer price index up just 0.1% in August as used car and hotel prices eased back from high levels.

Long-dated NZ government bond yields declined almost 8 basis points as they fell with US bonds.

Short term bond yields are more influenced by the Reserve Bank of New Zealand and so remained unchanged, resulting in a somewhat flatter yield curve.

“The seemingly outsized impact of the 0.1% miss shows just how sensitive markets are to inflation at present,” said ASB economist Mike Jones.

“This looks to be a classic ‘risk-off’ story with US equity markets under pressure late in the session”.

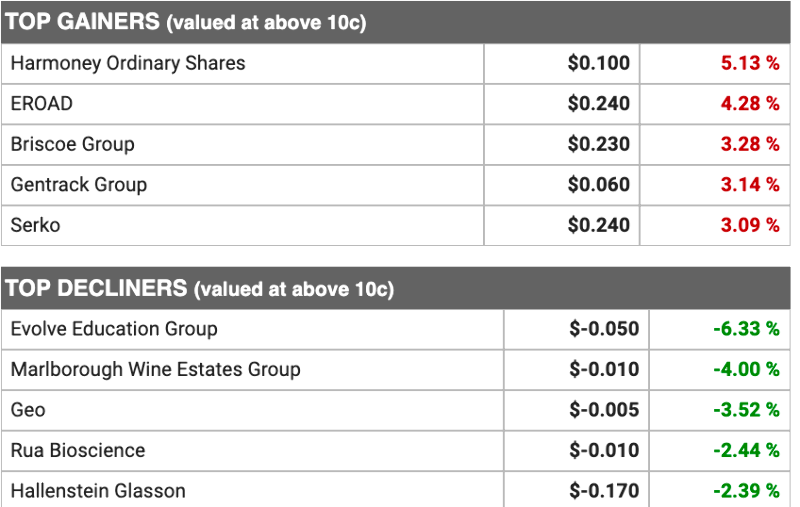

Synlait Milk led the NZX 50 Index lower, falling 2.2% to $3.09, but equities overall were fairly evenly split between gainers and decliners.

Travel company Serko posted the day’s biggest gain, up 3.1% at $8.00, followed by Skellerup Holdings which advanced 2.6% to $5.48.

Market news updates were few and far between. NZ Automotive Investments fell 0.9% to $1.13 after telling investors it was still being negatively affected by the Auckland lockdown.

NZAI now expects underlying net profit after tax for the half-year ending September to be between $1.4m and $1.6m, down on the prior comparative period of $1.9m.

“The company’s performance has been affected by the continued closure of its six Auckland dealerships, as well as the closure of the vehicle processing hub while Auckland remains at alert level 4,” it said.

The NZ dollar was one of the worst-performing currencies, slipping below 71 US cents amid a broader risk-off vibe.

“A risk-off vibe drove price action across major currencies through trade on Tuesday, bolstering demand for the JPY, CHF and USD while forcing commodity currencies lower,” currency exchange OFX said in a note.

“The US dollar shifted sharply lower in the wake of CPI data before risk appetite helped drive the world’s base currency higher into the morning’s open”.

| « F&P Healthcare drags NZX50 down | NZ shares down on ‘staggering’ GDP number » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |