Traffic builds on the road to full licensing

Adviser traffic on the road to full licencing has built up to a steady flow as individuals and companies look to the future with the Financial Markets Authority so far approving 80 applications.

Tuesday, September 21st 2021, 12:00AM  8 Comments

8 Comments

by Matthew Martin

The Financial Markets Authority's (FMA) director of market engagement and acting director of regulation John Botica says he's pleased with the numbers so far but after just six months under the new regime it would be hard to identify any trends.

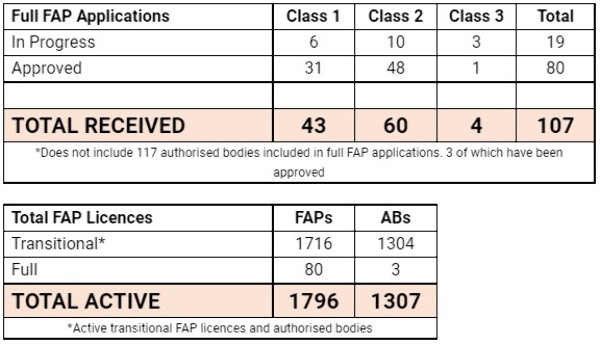

As of yesterday morning, a total of 80 Financial Advice Provider (FAP) licences had been approved by the FMA across all three licence classes with another 19 in progress (see chart below).

"But what I'm impressed with is when we have been getting out and talking to advisers across the country is that a lot of them are thinking about what their business will look like in the future."

Botica says roughly 60% of applications are for Class 2 licences for businesses with between two and 10 advisers whereas in March about 50% of transitional licences were for single adviser businesses.

"They are looking forward at their structures, some may be retiring and succession planning and some may be looking at buying another advice business in future."

Botica says the initial fear of the new advice regime is fading and "...the more questions we get asked helps us to refine our material and application process".

"The first hurdle may have been the fear of the unknown but the application process is straightforward, but you do need to prepare and get your ducks in a row.

"I think there's a much better understanding of the process among advisers now."

Botica says what has been consistent is the total number of advisers in the market and "...we know there were some advisers who applied for a FAP but are now authorised bodies, so some of the numbers are slowly moving around as advisers think of their business structures.

He says turnaround times for applications can change depending on information received and the number of applications at one time, but some have been processed within a few weeks.

"We have set a standard of 60 working days for each one, but we are coming in a lot faster than that right now."

He says the FMA's website is packed with information for advisers who can also park an application once it's been started to complete at a later date.

The FMA can't access partial applications and will only act once a full application has been received.

The FMA's principal consultant for market engagement Derek Grantham says the FMA is working with advisers and firms to make sure they understand the process and what type of license they should be applying for.

"It also means reflecting on what you have learnt over the past six months, and what you think the future will look like for your business.

"One of the first big decisions you need to make is which type of FAP full licence is right for you, as this determines some of the things you need to think about now, and have in place, in support of your full licence application," Grantham says.

For more information about what licence class to apply for, click here.

| « Measuring adviser wellbeing in NZ | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

5 of those 23 months are gone, and we have a lot less than 375 in. So if they are running less than a third of that average, they absolutely should be lightning fast.

We're now at 1609 over 18 months - almost 90 per month. How long until the average needed to get everyone through exceeds the FMA's processing capacity - and that 60 days thing is out the window?

Yes, I know not all of those transitionals will go to full, but there will be a ton of ABs (which are hard to predict/count) - and if we're 3 for 117 so far, does that mean ABs are harder to get through?

I'm not surprised, most advisers are still digesting what's going on and they will leave it to the last minute like they always do.

Then there are the ones where the trans was either cover before retiring or they have found a home and aren't going to use it.

As has been observed before by myself and others, there is a significant state of flux in distribution land and still many hundreds of advisers "on the move" between groups/FAP options and figuring out their final licencing position - and that IS a significant factor amongst the smaller (Class 1 or Class 2) potential licencees.

I find it intriguing that the larger and far more complex business applications amount to a grand total of 4. There is no shortage of large companies who must themselves be applying for full FAP status at some point who appear very willing to tell advisers how they should conduct themselves and I wonder where they are in the process?

That is merely an interesting aside though; the bigger issue I see which is having an impact upon the number of Transitional Licence holders applying for full licence is simply the mish-mash of messages and confusion being created by commercial organisations with vested interests who are on occasions downright misleading with the information they put into the market.

Lots of Transitional Licence holders are utterly confused in other words. They are not confused about how to be good advisers or run good businesses, but they are increasingly confused about what they have to do in order to obtain a licence because of the constant barrage of vested interests giving them conflicting information.

Perhaps more rapid progress would be made if a few service providers would cease and desist with doomsday-selling tactics for a start, and a few more large companies got their own house in order before telling distribution their versions of the truth.

For any advisers out there who are utterly confused by it all, just read the FMA Guide To Full Licence Requirements. It is actually very clear and very helpful. And maybe stop listening to outfits trying to sell you something or control what business you do.

the FMA has no idea what advisers are going through right now,

sooooo : https://researchsurveys.deakin.edu.au/jfe/form/SV_dm7Rg1prOAygET4

Sign In to add your comment

| Printable version | Email to a friend |