Experts ponder compulsory KiwiSaver

The number may be daunting - more than $1 million for a couple to retire comfortably - but many Kiwis won't have anything close to that in their KiwiSaver accounts by retirement age.

Wednesday, September 22nd 2021, 1:23PM

by Matthew Martin

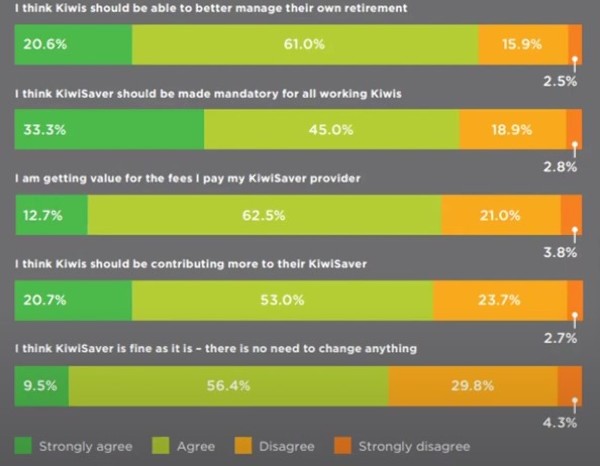

So, should KiwiSaver be made compulsory?

Considering 35% of New Zealanders over 60 don't know how much they need to retire comfortably, according to research provided by the Financial Services Council (FSC).

Compulsory KiwiSaver was the main topic of discussion during a recent 'FSC Connect' panel event held during the Level 4 lockdown in Auckland.

On the panel were Craigs IP head of emerging wealth Helen Skinner, Milford Asset Management head of KiwiSaver distribution Murray Harris, Westpac NZ head of investments Nigel Jackson, Trustees Executors chief operating officer Geoff Rimmer, along with FSC chief executive Richard Klipin and FSC content manager Clarissa Hirst.

Murray Harris says Kiwis don't feel well prepared for retirement and talking about money is not really a Kiwi thing.

"And we have a low level of financial literacy...for a no-frills retirement, some people are going to be very scared when they see how much they will need and many will have to continue working when they get to retirement age."

Harris says young people are in the best position to start saving but many don't even think about it until in their 50s.

"We must acknowledge that KiwiSaver has been hugely successful and has been the best financial product and savings product New Zealanders have seen.

"But for the people under financial strain or on lower incomes moving to compulsion could be a stretch for the household budget, especially for people living week to week.

"But it is a discussion that needs to happen. There is an option for compulsory employer contributions with some tax relief from the government," Harris says.

Skinner says New Zealand is following a similar trajectory to pension funds worldwide, particularly around compulsion.

"There's a lot of New Zealanders who have no idea how KiwiSaver works and how much they should be investing.

"It's all around how much do I actually need at the endpoint and working back from that," she says.

Jackson says people do recognise the importance of saving for their retirement but we are not doing enough, especially for the more vulnerable.

"But compulsion is a blunt instrument and is dangerous territory for politicians.

"Obviously, it [KiwiSaver] works better if people are in long term employment and for those on higher incomes."

Rimmer, who has had three decades of experience with the Australian superannuation scheme, says there's already a significant underfunding gap identified by the research.

"The Aussie system has matured over three decades starting at 3% contribution and up to 9% for a while...and over time there will be less and less reliance on the taxpayer."

He says few people think about retirement in their youth, but the more money in a scheme like KiwiSaver means people have more interest in their savings.

"Compulsion on its own is not a good idea," he says.

"There are other levers you can pull to make sure you don't end up with a big difference between the haves and have nots."

| « MMC picks up another default KiwiSaver provider | KiwiSaver funds soar, non-contributors still a worry » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |