AMP increases focus on digital distribution

AMP exits aligned financial advice channel and plans to launch new funds and focus on a digital strategy.

Monday, December 6th 2021, 7:43AM  6 Comments

6 Comments

AMP Wealth Management is expected to generate less profit in the current financial year as it battles margin headwinds.

“Wealth management revenues in recent years have been impacted by margin compression following heightened market competition (particularly in KiwiSaver) and increasing regulatory focus on fees,” AMP said in an investor presentation last week.

The road to increased profits is limited as the business is already “operationally efficient business, with a high return on equity and low cost to income.”

“There is limited scope for further cost out with bottom line growth to be driven by improved investment performance and cash flows.”

It says it has continued to simplify it operations through automation and digital transformation" and has reduced its its customer services operations by 30%.

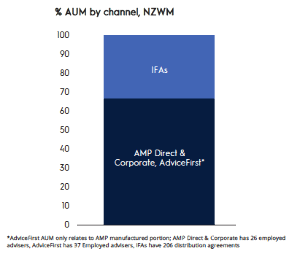

The company says it has "repositioned distribution to be predominantly direct to market via employed advisers (AMP and AdviceFirst) and fully exited aligned advice."

AMP plans to launch new unit trusts in the first half of next year, "leveraging investment in automation and (its) BlackRock partnership."

Like many other managers it is focussing on sustainable investments "reflecting New Zealand market dynamics.

Earlier this year AMP moved $9.6 billion to BlackRock as it shifted from active management to a passive approach.

| « Foundation Advice - proving the naysayers wrong | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

I understand that there is a new biography coming out next year titled "AMP - How to take a financial services brand of 170 years and destroy it".

No doubt it will be a best seller amongst advisers even though we already know the story.

The chapter on AMP's relationships with advisers will be particularly illuminating.

Sign In to add your comment

| Printable version | Email to a friend |