Advisers told to move beyond trust to inspiration

Advisers have been receiving advice on the best way to work in an age where trust is no longer the main driver of a deal.

Friday, September 30th 2022, 4:09PM

by Eric Frykberg

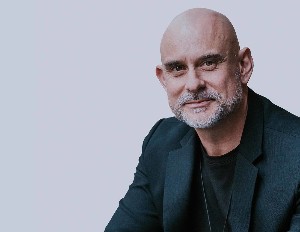

It came from an Australian speaker on motivation, Matt Church.

Matt is a leadership expert and the author of 13 books including his latest, “Rise Up: An Evolution in Leadership.”

He was addressing a conference of business professionals in Christchurch organised by Financial Advice NZ.

Church spoke on a variety of subjects, one of them a reduction of trust - with dealings more likely to be based on price than on years of close work with another person.

He told his audience this was a global issue and was based on a distinct change in attitude: people want to buy, they don’t want to be sold to.

He said this required adviser to ask three questions about their relationship with their client.

“Do I do something to you - and compliance doesn’t want us to do that - or do I do something for you - and that is what most facilitating advisers do - or do I do something with you.

“And the shift from ‘to’ through ‘for’ to ‘with’ is the shift that we need to get conceptually in this industry, to partner with people and not to do things to people or for people.”

Church went on to say the way to build trust was not relational anymore. It was not even facilitating, which was giving people what they wanted. It was inspiring them with a belief that you had something that they needed.

“It is a shift from caveat emptor, which is buyer beware, to seller beware.

“What that means is that we have moved on from selling and pushing out ideas onto people, to creating environments and conditions in which people want to buy.

“I don’t think trust is the issue, I think inspiration is the issue.”

Church’s remarks came against a background of mortgage advisers saying their job was often more than a simple market transaction. People’s emotions often got in the way, especially when young families were yearning for a home for their children.

Even when there were no personal feelings involved, there was often a lot of intellectual challenge in getting a complex deal over the line, especially with the CCCFA there to make things extra hard.

Church said high-level compliance rules were definitely a factor in changing the business environment for advisers, and he argued the rules were even more stringent in Australia than here.

And he went on to say one way for advisers to prosper in this environment was to develop the ability to work particularly well for set groups within society - “owning a category of thought” as he put it.

“If you are the adviser for divorced women, brilliant, if you are the adviser for the almost dead, brilliant, if you are the adviser for people with growing families, brilliant.”

“Own a category of expertise, and work for that type, and develop expertise on that type, and you inspire them.”

“Your job is not to convince people to buy, your job is to stand in the conviction of what you know, and great advisers do that.”

| « Non banks and finance companies say banks should not get special treatment | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |