Listings lift more than 70%

The number of properties for sale across the country continued to soar last month, lifting a record 76% when compared to August last year, while average prices continued falling to stand at $899,200 nationally, the Trade Me Property Price Index shows.

Wednesday, September 28th 2022, 11:05AM

Property listings have now risen for nine months straight and are well above pre-pandemic levels. Last month was the third month in a row where listing numbers spiked by more than 50% year-on-year.

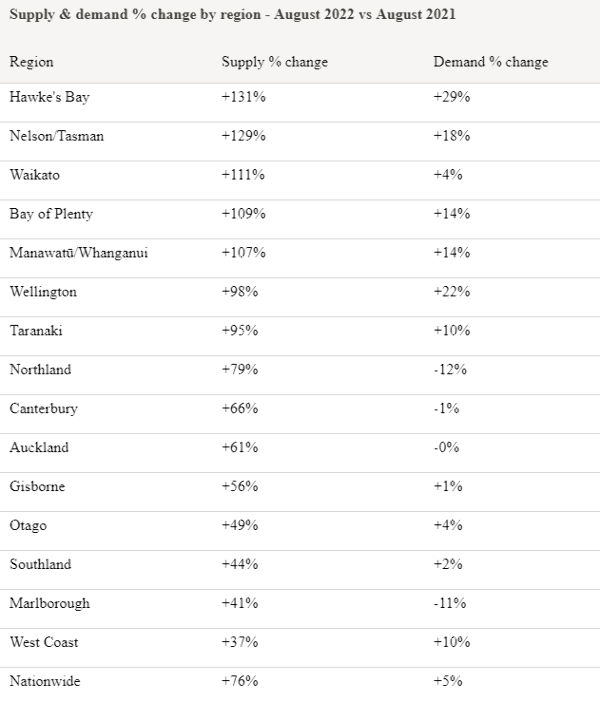

Listings in every region were up by at least a third last month when compared with the same month last year and there were some standouts. Waikato had the highest number of properties for sale ever last month, with supply more than doubling in the region when compared with August last year.

Hawke’s Bay, Nelson/Tasman, Bay of Plenty and Manawatū/Whanganui regions also had over double the number of properties for sale in August when compared with the same month last year.

Trade Me property sales director Gavin Lloyd says while demand for property is also on the rise, it is no match for the large increase in supply.

He says If supply peaks continue to outperform demand, Trade Me expects to see prices fall even further.

Asking price falls

The national average asking price was down 1% last month when compared with July and is now below $900,000 for the first time since October last year.

The biggest month-on-month average asking price drops were in Wellington, down 4% and Nelson/Tasman, Taranaki, and West Coast, down 3%.

“Prices are falling as a direct result of sky-high supply paired with comparatively low demand, taking the pressure off buyers and forcing sellers to lower their price expectations,” says Lloyd.

“This time last year, the national average asking price for a property was up 6% in August, - the smallest year-on-year increase in more than two years.”

Lloyd says August is the second month in a row where prices rose by less than 10% year-on-year, which is remarkable coming out of two years of consistent double-digit price growth.

Smallest increase on record

The Wellington region had an average asking price of $875,700 last month, putting it under $900,000 for the first time since September last year.

When compared with August last year, this marks a 1% increase, the smallest year-on-year rise on record for the region.

Wellington city’s average asking price fell by 4% month-on-month, to $1,003,300. It is still the most expensive district in the region, followed by Porirua at $958,650 and Kāpiti Coast at $884,900.

The capital’s most popular property in August was a five-bedroom, four-bathroom house on Murphys Road, Porirua. “The house was watchlisted 414 times in its first seven days onsite.”

Smallest growth in two years

In the Auckland region, August's average asking price jumped 2% when compared with the year prior, to $1,127,550. This is the smallest jump since February 2020.

The most expensive district is North Shore City, sitting at $1,349,200. Rodney came in behind at $1,279,000, followed by the Auckland city where prices fell by 3% month on month to $1,228,600.

Last month’s most popular Auckland property was a four-bedroom, two-bathroom house on Piha Road in Waitakere City. “It was watchlisted 931 times in its first seven days onsite.

| « Rent rises could contribute to more inflation | Building consents flatten, prices rise but construction carries on » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |