Listed companies beef up retail investor relations with new portal

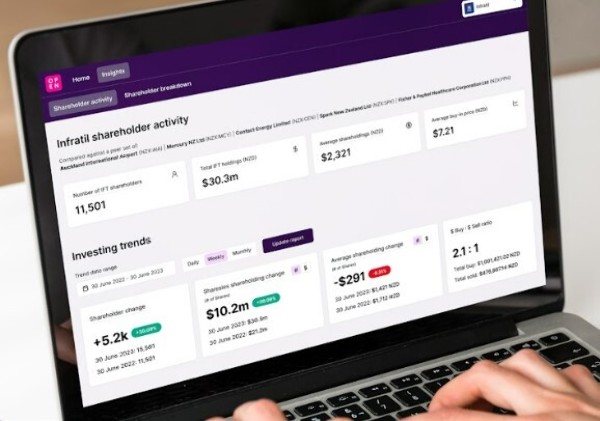

Sharesies has launched a portal giving New Zealand and Australian-listed companies a view of what their retail shareholders are doing.

Thursday, December 14th 2023, 6:41AM

by Andrea Malcolm

Sharesies Open gives listed companies data and analysis of their shareholders who are on the 600,000 member Sharesies platform.

It includes the average age of shareholders, the period in which shares are held, buy-in and sell prices, real-time investing activity, and the number of investors who have the company on their watch lists.

Susannah Batley, Sharesies general manager of company partnerships, says companies often don’t have much visibility about why retail customers might be investing in their company.

Shareholder engagement has traditionally focused on institutional investors because companies lacked the technology to easily communicate with retail investors.

“Until now, it’s been almost impossible for companies to have a detailed view of their retail shareholder base, given the spread and the large number of individuals.”

Retail shareholder sentiment

Unlike institutional investors, retail investors don’t get one-on-one calls and meetings but by aggregating and analysing the data from the Sharesies platform, companies can better gauge retail investor sentiment.

“Sharesies Open is about making sure companies are engaging all their shareholders,” she says.

“We know that retail investors invest for all sorts of reasons apart from good returns. This allows companies to get a more comprehensive understanding of the perspective of their retail investors around topics such as ESG, strategic moves and return on investment.”

She says Sharesies retail investors are well aware of social and governance issues.

“I’m continually inspired by this, as younger generations are coming into investing and they want to support companies to create better futures for everyone.”

The portal lets companies communicate directly with retail investors via Sharesies’ digital channel and track analytics such as open rates and clicks, as well as subsequent trading metrics post an announcement (such as buys, sells or new investors).

Batley says previously communicating with retail investors has been limited to annual general meetings or when results are emailed via a registry.

The voice of the retail investor shouldn’t be underestimated and part of the growing sentiment around looking after them is strengthening their overall value equation as many shareholders will also be customers, she says.

“Data from overseas shows that when you have that customer shareholder overlap you get greater loyalty, less churn and greater spend from that customer point of view.”

Features in the pipeline include enabling shareholders to submit questions and the ability for companies to run polls.

Companies can also compare investing activity with five like-minded peers to see whether investors are buying across a sector or favouring specific stocks.

About half a dozen companies are using the portal including Mainfreight, Freightways, Infratil, Rua and Black Pearl. There is a two tier subscription fee for base level service and more comprehensive analytics and a small variable fee each time they send a communication.

In a statement Mainfreight managing director Don Braid said Sharesies Open provides visibility of Sharesies retail shareholders which was largely lacking before and he was looking forward to understanding the group more.

Infratil CEO Jason Boyes said the portal enables the company to connect with its shareholders on the platform, and get meaningful feedback through the data and analytics. “This will help greatly with our retail investor relations.”

Some fund managers and providers have also asked for access to the portal, says Batley. “Again it’s that sort of data - to help those issuers to be able get that feedback.”

| « BIG to govt: the FMA should redirect focus to high-risk areas | Jarden, NAB form FirstCape including Harbour » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |