Housing consents rise from low base

House building activity is increasing, but off a low base, the latest building consent figures from Statistics New Zealand show.

Wednesday, August 1st 2001, 10:17AM

by Jenny Ruth

There were 1,640 new dwellings worth $238.6 million approved in June of which 244 worth $19.8 million were apartments. That compares with 1,598 dwellings worth $240.3 million approved in June last year, of which 174 worth $20.9 million were apartments.

But the number was down from the 1,856 dwellings worth $270.6 million approved in May which was the highest monthly figure since May 2000 when 2,103 dwellings worth $288.3 million were approved.

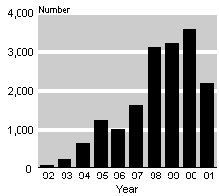

In the year ended June, there were 19,277 dwellings worth $2.83 billion were approved, down from the 24,244 worth $3.37 billion approved in the previous year. The number of apartments approved fell to 2,180 worth $189.3 million in the year ended June from 3,566 worth $306.2 million in the previous year.

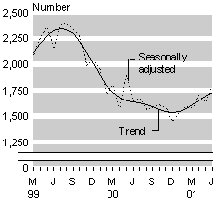

Statistics New Zealand says the trend in the number of dwelling consents has been growing on average by 2% a month since December.

|

|

| « Mortgage brokers need to be regulated: Caird | Mortgage Brokers Association claims high standards » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |

Number of New Dwellings Authorised

Number of New Dwellings Authorised Number of Apartments Authorised

Number of Apartments Authorised