OCR on hold: Where to for home loan rates?

With the Reserve Bank keeping its official cash rate on hold, attention now turns to when it will start cutting rates.

Wednesday, July 12th 2023, 5:12PM

TMM wraps up key comments from some economists. For mortgage holders the message is that the we are near peak home loan rates.

Comments from the RBNZ sum up its view:

The lagged effects of previous monetary tightening is still passing through to households as more households move off lower fixed rates.

Average mortgage rates on outstanding loans have increased from about 3% in early 2022 to about 5% currently. Based on current commercial bank pricing, average mortgage rates are expected to reach around 6% in early 2024.

The Monetary Policy Committee discussed the appropriate stance of monetary policy. The Committee agreed that interest rates will need to remain at a restrictive level for the foreseeable future.”

Barclays takes one of the more optimistic views about when rate cuts will come and even suggests they could be this year.

“Barclays continues to expect rate cuts in the first quarter next year but note the risk of a cut later this year is a possibility if GDP contraction deepens.

“We do not read the statement as being too hawkish.”

It says that given all five members of the Monetary Policy Committee, who voted to hike at the May meeting, agreed to keep the OCR unchanged in the most recent meeting, it can be read as dovish.

“This confirms the RBNZ’s long hiking cycle has finally come to a close.”

Barclays expects 25 basis point cuts at all the meetings in the first six months of 2024, with the cash rate reaching 4.75% by May 2024.

These predictions are two quarters before that implied by the RBNZ’s path published in May.

It says the committee was not expecting economic contraction in earlier quarters suggesting the tightening is passing through the economy faster than the bank expected.

ASB is expecting inflation to fall back into the 1-3% target band in the second half of 2024, fairly similar to the RBNZ’s view.

“Retail spending and construction remain under pressure, with further mortgage rate pressure still to come over the rest of this year, as some borrowers refix mortgages at higher rates.

“Rising unemployment will moderate wage growth and bring down inflation over time. In the short term the cost pressures that businesses are facing remain high. The main thing the RBNZ has to be wary of is the housing market, which looks like it is bottoming out.

“We remain of the view that the RBNZ has done enough to get inflation under control. The bank will remain wary for the time being so won’t relax. And it continued to emphasise that restrictive monetary policy is needed for some time: we don’t expect OCR cuts until May next year, give or take.”

ASB notes the RBNZ will “no doubt keep an eye on the housing market, given it looks like it is turning the corner, and could hold inflation up if it triggers a wealth-related spend-up and props up residential construction.

“In the short term this risk looks acceptable, particularly given the extent to which house prices have fallen. However, the October general election is likely to offer quite different housing-related policies that could influence the housing market, something to watch for later this year.”

Corelogic suggests mortgage rates appear to be at a generalised peak, and this will allow households to quantify their ‘worst case’, with some starting to make property decisions again.

“However, just because the OCR may have peaked, this doesn’t preclude some modest changes to actual mortgage rates by individual banks. After all, their pricing decisions can be affected by many factors, not least offshore wholesale rates, which feed into longer term fixed mortgage rates in New Zealand.

“Recent headline-generating tweaks to rates by most banks are a good reminder of this.

“To be clear, we still think that this housing market downturn is almost over – for better or worse, depending on your perspective.”

It says the next property cycle may remain pretty muted by past standards.

“Inflation (is) still well above target, albeit slowing, the OCR may not be cut until later in 2024, leaving mortgage rates elevated for longer too, and keeping a fair degree of strain on housing affordability. Potential caps on debt to income ratios for mortgages (both new and existing) from March/April next year are still hovering in the background too.”

Kiwibank says the key line in the central bank’s statement (inserted twice for good measure) was, “The Committee agreed that interest rates will need to remain at a restrictive level for the foreseeable future, to ensure consumer price inflation returns to the one to 3% target range while supporting maximum sustainable employment.”

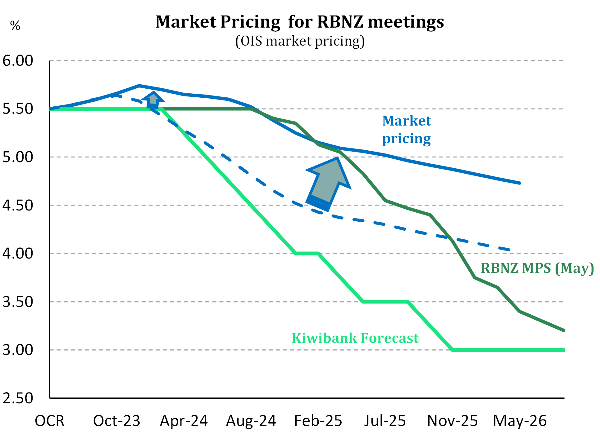

Kiwibank disagrees with market pricing for the OCR which appears too high (see graph).

Financial markets have rampaged recently, with wholesale swap rates gapping higher in illiquid moves.

“The two-year swap rate has lifted from a recent low of 4.92% to 5.75% on Monday. The two-year rate incorporated an OCR hike to 5.75%, and no rate cut until very late in 2024.

“We disagree with market pricing, again, and expect a sharp move lower into year end. OIS (OCR) pricing needs to be steamrolled lower, with a flat OCR track at 5.5% most likely. The graph (above) highlights the dramatic lift in OCR pricing.

The chart also highlights the RBNZ’s OCR track and Kiwibank’s forecast track. Both are lower than the market.

“We expect the OIS strip to move back towards recent lows, taking the all-important two-year swap rate back down to 5% by Christmas, and then ultimately head below 3% over the next few years.”

| « BREAKING: Official Cash Rate remains on hold | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |