KiwiWrap KiwiSaver has highest average balance

With an average balance of more than $120,000, KiwiWrap is way ahead of other KiwiSaver providers, although it has under 300 members.

Wednesday, October 25th 2023, 6:00AM

by Andrea Malcolm

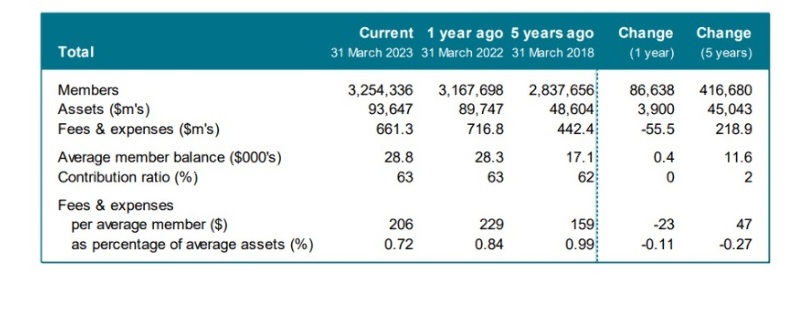

Melville Jessup Weaver’s KiwiSaver market review for the year to March 2023 revealed the top ten providers for average balance size, with only one major bank making the leaderboard.

The Consilium-owned KiwiWrap KiwiSaver Scheme is a self-select scheme designed for investors wanting customisable investment choices. It focuses on making sure its members benefit from financial advice through advisers who can monitor and report on clients’ portfolios through Consilium Wrap (FNZ). They and investors have access to more than 400 investment options, including international shares, ETFs and bonds.

From KiwiWrap’s $120,000 it was quite a drop to the next three biggest balances on average; MAS at around $70,000 followed closely by Craigs and Milford. Coming in at just below $60,000 were Maritimes, newcomer Sharesies (with just 16 members at the period covered by the report) and Summer. They were followed by ANZ’s OneAnswer, Select and InvestNow all hovering above $50,000.

The bottom five (all around the national average of $27,000) were Booster, Aurora, BCF (Brethren Christian Fellowship), the Muslim targeted AE (Always Ethical) and BNZ.

The report looked at the highest and lowest contribution ratio. Sharesies and KiwWRAP led but because of their low membership numbers were not that informative but the next three NZDF, Maritime and Supereasy (at 80% or just above contribution rates), which the report said, may reflect good engagement with restricted membership pools. Aurora, Kernel, Kōura, Pathfinder and BCF all had high engagement rates of just below 80%.

Changes bubbling from below

On other key statistics, rankings by member numbers were fairly static with ANZ at the top, followed by ASB, Westpac, KiwiWealth (now part of Fisher Funds) and BNZ . However, five schemes managed to grow their member base by more than 10,000 people, with Simplicity adding more than 15,000.

For assets under management in a single fund, ASB KiwiSaver Scheme overtook ANZ to reclaim the title of largest single scheme (almost $14.5 billion with $464m added).

Otherwise, the ordering of the top ten schemes did not change ASB, ANZ, Westpac, BNZ and AMP. In terms of asset growth, Milford stood out with a gain of $832m, significantly reducing the gap to AMP in fifth place.

Fisher Two added $681m, although this mostly reflects the transfer in from the Aon scheme which was closed over the year. Generate, the aforementioned ASB, and BNZ round out the top five in terms of growth. Several smaller providers have seen strong growth relative to their asset base. Aurora and Kōura more than doubled in size, while InvestNow was just shy of this mark. In its first five months, Kernel gathered $43m.

Once accounting for consolidated ownership, competitiveness measures weakened this year, bucking the trend seen since 2015. The purchase of Kiwi Wealth by Fisher was the main driver.

In aggregate, Fisher Funds accounted for $14.4b, having taken over the Kiwi Wealth KiwiSaver Scheme which had $6.7b under management as of March 2023. This saw Fisher Funds group reach a comparable size to ASB ($14.5b). ANZ group ($18.7 billion) remains the largest KiwiSaver participant.

Once accounting for consolidated ownership, competitiveness measures weakened this year, bucking the trend seen since 2015. The purchase of Kiwi Wealth by Fisher was the main driver, the report said.

| « Another leading KiwiSaver provider calls for changes | KiwiSaver - is consolidation on the cards? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |