Ten things to know about mortgage debt

The market has been relatively subdued over the past 12-18 months, alongside the downturn in sales volumes and property prices.

Wednesday, December 6th 2023, 12:37PM

by Sally Lindsay

But there are now signs of a turnaround for those variables, and lending activity is also starting to rise – albeit from a low base. So what’s the current lie of the land and what are key things to keep in mind?

CoreLogic’s chief property economist Kelvin Davidson takes a deep dive into the mortgage market stats.

1. New lending flows over August-October were 4% higher than a year ago

The Reserve Bank figures show gross new lending flows for house purchases, bank switches and loan top-ups over August-October were 4% higher than a year ago, but the total of $16.8 billion is still well below the figures for the same period in both 2020 and 2021, of $21.9 billion and $22.8 billion respectively.

2. Loan to value ratio rules are still biting fairly hard

Only 0.3% of investors got a loan in October with less than a 35% deposit, and only about 7% of all owner-occupiers (first home buyers (FBHs and existing owners) borrowed at less than a 20% deposit. The allowable cap, or speed limit, for that low deposit owner-occupier lending is 15%.

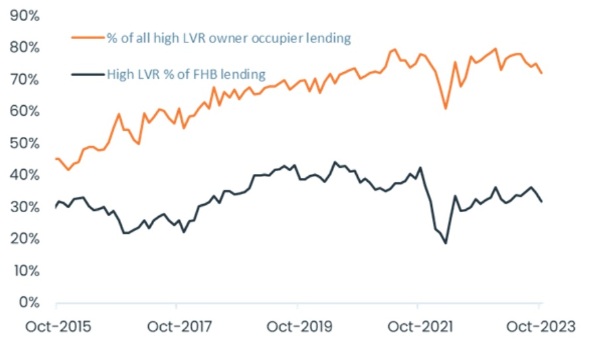

3. FHBs, however, are certainly capitalising on the speed limit

Around one-third of FHBs who got a loan in October did so with a low deposit (or high LVR), and they’ve fairly consistently been accounting for 70-80% of all owner-occupier lending at a low deposit.

High LVR first home buyer lending: Source RBNZ

Source: RBNZ

4. FHBs also take out relatively large loans

The average in October was just short of $562,000, versus the investor figure of around $493,000.

5. So-called ‘risky’ lending is not much of a problem at present

Only about 17% of lending in October was interest-only (versus figures of as much as 40% in the past), and loans at debt to income (DTI) ratios of at least seven are also ‘under control’. That DTI bucket has accounted for only about 1% of FHB loans recently, and less than 8% for investors. Through 2021, those same figures for investors were typically 35-40%. The key handbrake here is simply high mortgage rates, which naturally limit the amount of debt that can be secured/serviced.

6. Latest industry-wide figures for a ‘special’ (high equity) one-year fix was about 7.3% and the two year rate is roughly 7%

The lows for those rates were 2.2% and 2.6% respectively. Across the stock of existing debt right now, the average mortgage rate is 5.3%, up from the trough of 2.7%, but still well below prevailing market rates

7. Total mortgage debt currently stands at $354 billion, versus an estimated value of our property stock of $1,585 billion

That’s an aggregate LVR of only about 22%, implying there’s a lot equity out there (at least on paper).

8. Even so, the mortgage repricing process is ongoing and will remain a key issue next year

About 54% of current loans are fixed but due to be repriced in the next 12 months, many of which will see a higher mortgage rate.

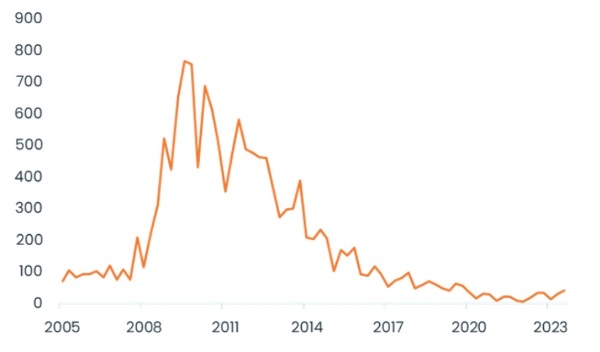

9. Amongst the existing loans, however, at least non-performing mortgages remain low, at less than 0.5% of the value of debt

CoreLogic’s data also shows that mortgagee sales are at low levels, just 41 in the third quarter of this year To be fair, no mortgagee sale can be a good thing, but at least they’re far lower than the post-GFC period.

Mortgagee sales per quarter

Source: CoreLogic

10. It’s encouraging that many existing mortgage-holders are ahead on their repayments

Recent Westpac data, for example, shows that on its books, about two-thirds of borrowers are at least three months in the black, with a median buffer of nearly $13,000. This pattern is likely to apply to the other banks too. need to Centrix data, however, shows there are about 19,000 mortgage accounts past due – up by 25% from a year ago, but from a low base.

So what are the key takeaways here? First, the labour market has been robust in the past few years, even though the economy has been flirting with recession. Job security has kept stress in the mortgage sector at low levels, even though households have had to significantly adjust their finances.

Second, however, the trend of households steadily adjusting to higher mortgage rates may not last forever, especially if there are some job losses in 2024. The mortgage repricing issue remains a key one to watch.

Third, and more generally, the post-Covid years have reinforced the key role of credit availability and cost in driving short-run trends in the housing market – the boom in 2020-21 when mortgage rates fell, and then the subsequent downturn as rates rose.

Migration, population changes, and housing supply are vital factors in the medium/long term. But due to ‘higher for longer’ mortgage rates, CoreLogic remains cautious about the potential speed of this emerging ‘upturn’ in house prices. Certainly, high interest rates – combined with low rental yields – are a key hurdle for investors looking to expand or start portfolios.

| « Market doesn't believe RBNZ's tough talk | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |