Ten years of success

Discipline, patience and a well-defined process, the key components of success for BNZ Investment Management Limited and Templeton’s long-standing association

Wednesday, October 27th 2004, 3:08PM

Ten years ago BNZ Investment Management Limited (BNZIM) joined forces with global funds manager, Franklin Templeton Investments Australia Limited (Templeton) to manage our active international equity portfolio. Templeton is a member of the Franklin Templeton Investments fund management group, which manages in excess of US$350 billion for clients worldwide.

The 10 year performance figures show how successful this association has been during a period that saw global markets both soar and make record lows.

Why BNZIM chose Templeton

Established in 1940, Templeton pioneered value style investing in global markets.

Since that time their value philosophy has driven the processes they use today to identify stocks that appear to be fundamentally sound, trading at discount to fair value.

Templeton’s foundation is built on a disciplined, yet flexible, long-term approach to value-oriented global investing. They apply a bottom-up, stock selection methodology sourced from a global universe of well researched stocks.

Templeton’s strict value philosophy focuses on the future earnings stream and/or asset value of target companies, steering them away from overpriced securities and markets.

The primary factor in their value analysis is a company's current price relative to its future or long-term earnings potential, or real book value, whichever is appropriate, evaluated with a five-year investment horizon.

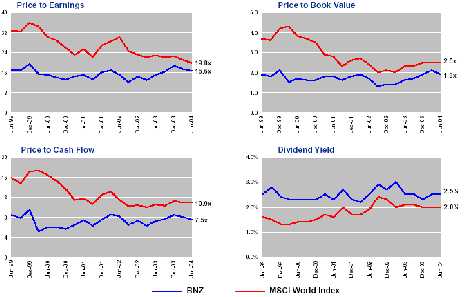

The following charts illustrate Templeton’s consistent application of the key measures used to assess individual stocks.

Templeton’s portfolio construction process revolves around three lists: a “bargain” list, a “hold” list and a “source of funds” list.

Templeton’s team of 34 analysts based around the world research the global universe of stocks for underpriced companies to bring to the “bargain” list, and conversely to put forward recommendations to move “bargain” stocks to the “source of funds” list as the market price approaches the analyst’s target price for the stock. Similarly, “bargain” stocks move to the “hold” list as the market price moves above the analyst’s recommended purchase price.

Benchmark weightings are ignored

Portfolios are structured completely from a stock selection orientation. There is nothing in the process that says that stocks held have to reflect the MSCI index weighting.

Today, for example, the portfolio is just over 30% underweight in North America, 14% overweight in Europe and 10% overweight in Asia compared to the MSCI weightings.

Between 1988 and 2000, Templeton held virtually nothing in Japan. Over the past three years there has been an increase in holdings listed on the Japanese market. This does not however mean that Templeton is bullish on Japan, it simply means more companies in this region look like good value.

The portfolio typically consists of around 100 stocks that are held for an average of five years. Annual stock turnover averages approximately 20%. This low level of turnover reflects Templeton’s patient approach to investing as the market can often take some time to recognise the value inherent in under-priced stocks.

Currency exposures are unhedged

Templeton does not hedge against currency movements. Many of the companies held within a Templeton portfolio have global operations and, as a result, a company may have a range of currency exposures that are very different to the currency exposure associated with its country of domicile. Templeton endeavours to understand the potential consequences of currency movements on a company’s future earning capacity as a part of its fundamental research.

BNZIM believes the patient long-term discipline that gives Templeton the courage to look beyond the short-term news, noise, and emotion that affects individual markets, should continue to reap rewards for patient investors. Templeton’s focus on searching the world for stocks that are under-valued relative to their fundamental worth provides the ongoing opportunity to consistently outperform and add value to the portfolio.

For further information on the BNZ International Equity Trust contact Karyn Kennard, Business Development Manager – Intermediaries on 09 976 5062 or 029 976 5062 or 0800 872 787, email, karyn_kennard@bnz.co.nz

| « BNZ celebrates 10 year anniversay | Scholarship details » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |