Market Review: September 2008 London Commentary

This month, Tyndall comments on the similarities – and differences – between the former high-flying Euro “tiger” economies and ourselves. This may well be the time we re-learn the benefits of economic independence, not constrained by broader economic system rules and constraints. Although challenging, we can manage our situation.

Tuesday, September 9th 2008, 1:36PM

The global economic slowdown, which now appears to be gathering pace, appears to be claiming ever more casualties, this time outside the rarified world of the hedge fund and investment banking community.The latest victims of the ongoing and profound change in the global financial environment have been the formerly high-flying countries of the Euro Zone periphery, which are now coming back down to earth with a bump.

We believe that their story makes interesting reading, not only in its own right but also in view of their similarities - and importantly their differences – to New Zealand.

When Spain, Ireland, Portugal, Italy and Greece announced their intention to join the Euro project, they benefited almost immediately from a decline in the levels of their domestic interest rates as hedge funds and others (including the now infamous LTCM hedge fund) indulged in what were called interest rate convergence trades.

These investment funds would borrow at the low interest rates prevailing in the German Deutschmark and then use the money to acquire the higher yielding Lira, Punts and other currencies but, in so doing, they ultimately forced the interest rates in the higher yielding countries to converge downward to German levels.

Despite the fact that it had taken Germany some forty years of monetary rectitude to gain its low level of interest rates, the other would-be Euro members gained these benefits in a matter of months.

The result for the ordinary ‘man in the street’ in Spain and elsewhere was a rapid drop in advertised borrowing rates to generation-lows (or in some cases, all-time lows) and, unsurprisingly, this situation resulted in a sharp pick up in domestic credit growth, particularly with regard to the housing sectors.

Naturally, property speculation and development became the norm in these economies. Then, when the Euro Project was finalised, these economies were given relatively low – and hence competitive – conversion rates into the Euro, with the result that the countries began their lives in the Euro with competitive currency rates and unprecedentedly low interest rates.

Given these circumstances, it was not surprising that the economies began to perform extremely well and as their growth rates accelerated they became known as the Euro Tigers. Unfortunately, a decade later, the situation has changed in these economies.

Far from being referred to as the Tigers they are now known by the much less attractive term of the ‘PIGS’ (Portugal, Italy/Ireland, Greece, Spain) following the emergence of a raft of admittedly related problems, most of which can be traced back to the beginnings of the Euro Project. Years of rampant property price inflation caused by the ECB’s low interest rate regime have raised people’s effective living costs to such an extent that wages have been obliged to chase property prices higher (had wages not increased, then residents would not have been able to live in their houses).

However, these higher land and labour costs have naturally raised the economies’ cost bases and we estimate that as a result of Germany’s more sedate cost base inflation, the PIG economies are now a third less competitive than they were in 2000. In fact, they may quite simply now be fundamentally uncompetitive within the context of their Euro partners.

Moreover, years of strong rates of consumer spending growth have left the economies with high current account deficits - caused by the domestic economies’ inability to supply all the goods necessary to feed the countries’ low-interest rate driven demand for goods.

Two years ago, funding such deficits proved relatively easy – global capital flows were booming and international credit was readily available but the onset of the global credit crunch over the last nine months has clearly changed this situation by making it much harder for the PIGS to fund their deficits.

Indeed, by most measures, the former Euro Tigers are now entering what is fast becoming a global economic slowdown in a very vulnerable state. Aside from their current account deficit funding issues and their poor competitiveness (which also appears particularly ill-timed given the current sharp slowdown in world trade growth), the countries are also encountering pricing and even investor solvency problems in their property sectors as the housing booms finally cool in response to the global credit slump.

In fact, the countries’ private sectors became so hugely indebted and debt-reliant on a day-to-day basis during the boom period but, now that credit availability is declining, households and companies are having to radically change their operating methods in order to save more, and spend less. Naturally, less spending has implied weakness in the domestic economies.

Clearly, this is a situation that suggests the potential for sharp economic slowdown and we estimate that Italy, Spain and Ireland may have been amongst the first economies in the current adverse global cycle to fall prey to a recession. As we note above, we would attribute their revealed vulnerability to the circumstances of their initial EMU membership.

To add insult to injury, we now find that despite the euro having contributed to their problems, the system does not let them respond. For example, they cannot depreciate their currencies in order to improve their competitiveness.

In fact, they can only improve their competitiveness if they take nominal pay cuts – an unpleasant prospect at any time and an unlikely one given the recent rise in subsistence costs. Similarly, they might like to cut their interest rates to ease the credit crisis, but their interest rates are determined by a central bank in Frankfurt that seems perversely determined to stamp out wage inflation in Germany by raising interest rates.

The countries have some wriggle room with regard to government spending and fiscal policy but even here there are Euro system rules and constraints. Rather like the countries which clung onto the old Gold Standard in the 1920s and 1930s with disastrous economic and political consequences (and the Euro works very much like a Gold Standard system), the countries’ membership of the Euro precludes them from attempting to soften the economic slump.

In a few years time, we suspect that the electorates in these countries will move to question their governments’ competence and indeed whether the adherence to the Euro System during such times of economic stress was the right thing to do.

New Zealand of course has some challenges at present and in some sense, these are similar in nature to those of the PIGS. For example, consumer debt ratios are high, the current account deficit is significant, financial stresses are emerging and, most obviously of all, it has recently suffered an intense property boom that now is turning to a bust.

But, where New Zealand scores handsomely over the PIGS is that the RBNZ is relatively free to cut interest rates in order to help ease the credit problems, even if this action resulted in a weaker currency. Although it is likely that lower official interest rates might not feed through immediately into retail mortgage rates (particularly given the number of fixed rate mortgages with time still to run), a lower cash rate would provide the banks with a useful boost to their margins and capital, particularly if international capital flows continue to dry up, as seems likely.

During the boom years of the mid 2000s, New Zealand lenders were frequently able to circumvent the RBNZ’s higher interest rate regime by tapping offshore funding (so that they could offer ‘great deals’ to their customers) but now we suspect that the reverse is true and the RBNZ may need to step in and allow the banks to circumvent the international credit crisis by providing cheaper domestic funding.

At the very least, such an action would help the banks to recover their profitability and hence willingness to lend, a vital first step in any recovery process. Naturally, allowing the banks to switch from external funding sources to internal ones will imply less money flowing into the New Zealand dollar, which in turn suggests that the currency might weaken, but as we have noted the RBNZ is not tied to a currency target, as are the central banks in the PIGS. At the same time, the New Zealand government is relatively free to use discretionary fiscal policy to support the economy.

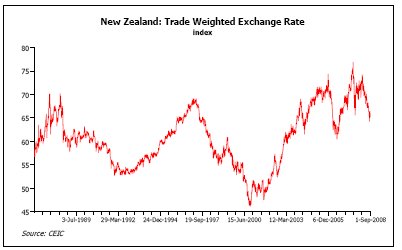

Of course, the cost of such policies might well be a weaker NZD exchange rate and some more expensive imports and foreign holidays, but for the economy a weaker NZD offers an important and useful safety valve. Traditionally, New Zealand has been able to at least partially insulate itself from global shocks by allowing its currency to take the strain and we see no reason why it should not do so again.

The effects of the chill wind from the Asian Crisis in 1997 were lessened by the weakening New Zealand dollar at that time just as the effects of the recent upsurge in global inflation were lessened by the strong New Zealand dollar last year. In open economies such as New Zealand, even relatively modest currency fluctuations can help to lessen the effects of external shocks.

Certainly, as the US finally succumbs to the recession that is already afflicting Japan, the UK and much of Europe, and the Asian economic boom continues to fizzle out (as is now becoming apparent), New Zealand should cherish its potential for economic policy independence. The fact that the RBNZ retains its independence and that it can cut interest rates when appropriate without facing a ‘hard and binding’ currency constraint is a welcome safety device for the economy and it is for this reason that we will retain our Otago home and not be tempted by a seemingly cheap Spanish beach house….

Andrew Hunt, London

To see this month Market Review numbers click here

| « Market Review: September 2008 Commentary | Market Review: October 2008 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |