Comparing selected banks

Following a week of rate changes we have pulled together a graph comparing pricing strategies.

Friday, March 18th 2016, 10:04AM  1 Comment

1 Comment

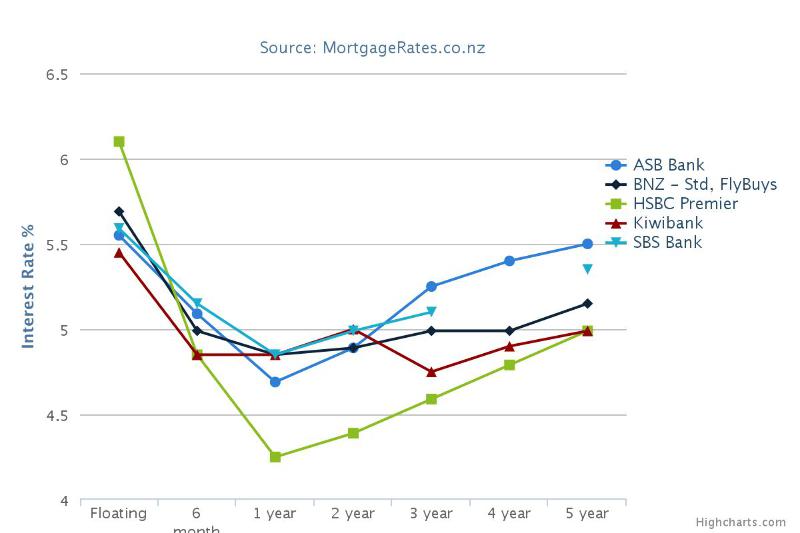

Here we have compared just five lenders who have taken different strategies to pricing their home loans. Also note this is just for standard rates. There are a range of Specials in the market too.

- HSBC - clearly it commands a market leading position in fixed rates, especially when its Specials are considered. However it is the only bank not to move its floating rate.

- Pricing remains in a tight band up to two years, but for longer terms there is greater divergence in pricing.

- SBS - While it often is a market leader, it's current pricing is a tad ordinary.

- ASB - Sharp on the one-year term but starts to look pricey further out the curve.

- BNZ - Continues to be reasonably aggressive compared to its big bank peers.

- Kiwibank - Sharp as usual except for standard two-year rates.

| « Mortgage fraudster gets jail time | More OCR cuts to come - ASB » |

Special Offers

Comments from our readers

On 21 March 2016 at 3:23 pm Craig Simpson said:

In your commentary you say ANZ - Sharp on the one-year term but starts to look pricey further out the curve. The chart does not show ANZ but ASB presume a typo Sign In to add your comment

| Printable version | Email to a friend |