Get real!

It is now nearly a decade since the GFC. Returns have been very acceptable across most asset classes over this period.

Monday, July 17th 2017, 9:00AM

by Jamie Young

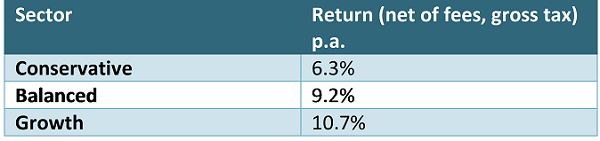

For example, over the last five years, the average KiwiSaver fund has returned the following:

Source: Morningstar KiwiSaver Survey March 2017

The above numbers are before tax. Tax can be tricky to calculate, but by looking at a few KiwiSaver Balanced fund updates we can see that tax has been around 1.4% over the last five years. So, let’s say returns for balanced funds have averaged 7.8% (9.2% minus 1.4%) after fees and tax.

Over this period, inflation has averaged just over 1.0% per annum so investors have made solid real returns (i.e. returns above inflation) of 6-7%. This will have helped dramatically with savings and retirement nest eggs.

The question now is can we expect this to continue?

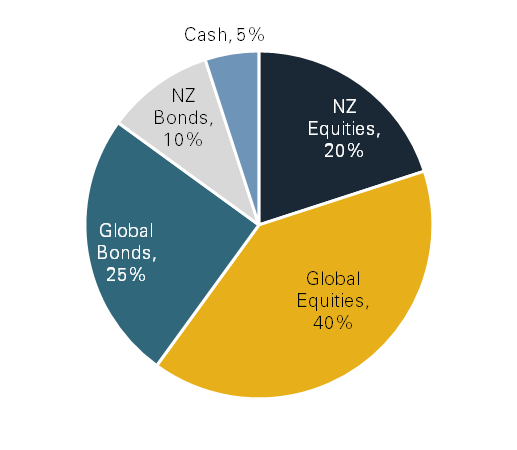

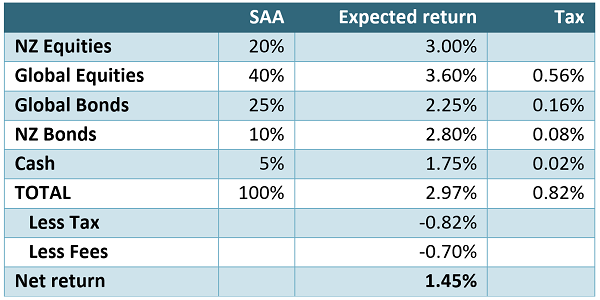

A standard 60/40 balanced fund may have an asset mix looking something like the below pie chart:

Let’s now look at the potential for returns out of each asset class.

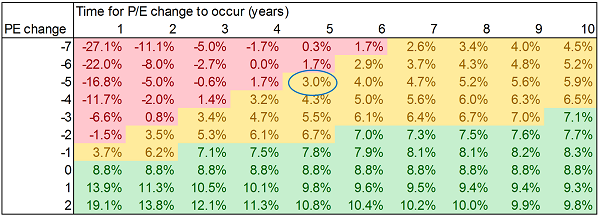

NZ Equities

Just over a year ago, I wrote an article breaking down future NZ equity returns using the Grinold and Kroner model. The full article can be found here. In summary, it breaks future returns down into Income Yield + Earnings Growth + Repricing (change in PE). The last item is crucial. If you believe that the current forward market PE can stay at over 19x then you can get a return of nearly 9%, but if you believe that the market PE must drop back towards its long run average of 14x then this tempers your future returns dramatically. I have updated the annualised returns table below as the dividend yield has fallen slightly (4.66% to 4.20%) and forward PE has risen slightly (18.9x to 19.5x). If you believe that the market PE will revert back to 14.5x over five years that gives you a return of 3.0% p.a.

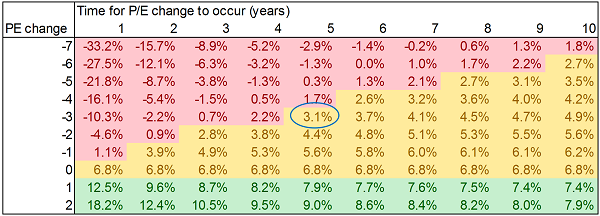

Global Equities

Repeating the same analysis on global equities using the following data and estimates:

- MSCI World current dividend yield is 2.4%. More buybacks occur in the MSCI index than in New Zealand, so we will add 0.5% for this.

- Labour force growth in US is projected to be 0.5% over next decade. We assume this for the rest of MSCI World (note we are not including emerging markets here).

- Assume same productivity growth as New Zealand at 1.4%

- MSCI world currently has forecast forward PE of 17.5x (which is notably lower than NZ).

This then gives annualised returns table below:

If you believe that the market PE retraces three points (to same 14.5x as NZ) over same five years this gives you a return of 3.1% p.a. Now, one could hedge some of the currency which should increase the return through the interest rate differential. Let’s say 50% hedged adds 0.5%. This gives total return of 3.6% p.a.

NZ Bonds

The NZ Government Index is currently yielding 2.4%, let’s say you have some corporate bonds as well, so overall yield is 2.8%. If rates fall further this helps returns, if rates increase it would hinder returns. We assume the middle ground of no interest rate moves, so that implies your return will be limited to the yield of the bond portfolio, 2.8% p.a.

Global Bonds

The yield on the commonly followed Bloomberg Barclays Global Aggregate Index is 1.5% (hedged to USD). If you add 0.75% for hedging back to NZD that suggests return of 2.25% (if again we assume no interest rate moves).

Cash

The NZ OCR is currently at 1.75%.

Summary

If you bring this together with estimated tax and fees of 0.70% you get a net return of 1.45%.

But this is a nominal return.

We know that the Reserve Bank’s inflation target is 2%. In fact, I used 2% inflation in calculating earnings growth in the equity returns above. If we then assume 2% inflation our 1.45% total nominal annual return becomes a real return of -0.55%. Yes, your savings in a decade’s time could buy you less than you could get today after you take account of inflation.

Faced with this what should an investor do? It seems you have three choices:

- Hope equity PEs stay elevated and bond yields low (the hope this time is different trade);

- Significantly increase your savings amounts to counter the lower expected returns (the sensible but painful trade);

- Invest in strategies that are not anchored to market returns.

Time to get real, people!

These commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

Jamie Young is a co-founder of Castle Point Funds Management.

| « Can experts predict market turning points? | Global Equities: Why it's time to rethink » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |