FMA pushes net returns over fees debate

The FMA has made it clear that promoting KiwiSaver funds on low fees only is wrong.

Tuesday, November 21st 2017, 9:04AM  11 Comments

11 Comments

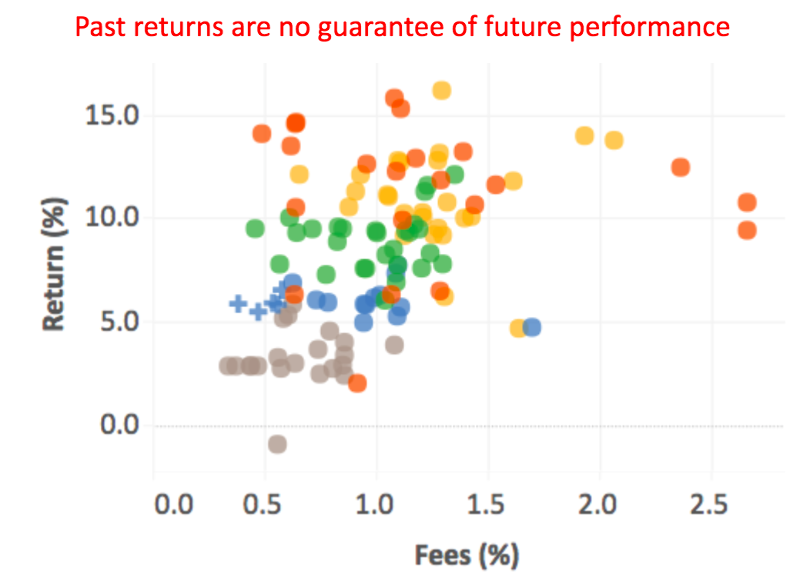

It launched a KiwiSaver Fund Tracker tool today which allows KiwiSaver members to compare funds on a fee and return basis.

FMA director of external communications and investor capability, Paul Gregory, said members needed to assess schemes on a net-return-after-fees basis.

He said schemes should not "just talk about fees."

"It's an equation and net returns is the answer."

The tracker tool uses the quarterly data supplied by all KiwiSaver schemes. It allows users to see which funds have high fees and poor performance and the opposite scenario.

Gregory says the FMA has built the tool to help KiwiSaver members understand their funds and to promote debate and discussion.

He doesn't see it as tool which should should be used solely to make fund selection decisions. Members should consider many other options such as responsible investing policies and service.

"The information in the KiwiSaver tracker about fees and return is an important factor in considering your investment, but it is not sufficient information to make an investment decision. This is why we link to providers and the Fund Finder tool to discover further information,” Gregory said.

"Success for us would be to see investors being price conscious," FMA director of regulation Liam Mason said.

TRY THE TOOL HERE

The Tracker allows people to arrange and sort the data. It shows:

- The risk profile, returns and fees for each fund.

- A percentage figure for how much of the return is paid to the fund manager in fees (excluding fixed management fees) and how much is paid to investors.

- Data that currently covers the past year and average five-year returns.

- Funds that have been invested for less than a year and restricted schemes are excluded.

| « PAA: Meeting failure could hold up Financial Advice NZ | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

Lets say I set up a managed fund with the lowest fees in the market and my investment strategy is to burn client money in my backyard.

In this case my net returns (-100%) are more important than my (low) fees.

Obviously I am being extreme to make a point - but it seems wrong to suggest returns don't matter, or that only fees matter.

Selecting a Kiwisaver fund based only on fees would be unwise unless you think the FMA has the competence to only allow "good" managers to run funds. But I am not sure why lawyers (=FMA) would be any good at doing that.

For me the various FMA quotes above taken at face value look reasonable.

Fees matter, but not entirely.

Unfortunately there is an industry element that have become fixated with fees, confusing value for price...

It seems silly to me for the following reasons:

Firstly, your “burn client money” example is a classic “straw man” argument although I admit some hedge funds do do it. More importantly though, a focus on returns ignores the fact that, according to the SPIVA analysis, 94.5% of active fund managers have underperformed over a 15 year period. In Australia for example 85% of international equity and Australian bond funds have underperformed the index over 10 years. It’s the same story in most markets but some fund managers outperform now and then. Mr Gregory would be chasing those historic returns but the SPIVA analysis shows that outperformance doesn’t persist. In fact Vanguard’s analysis suggests that outperformers tend to then underperform. If performance doesn’t persist what does? Fees.

My worry is that this sort of ignorant comment from the FMA will be used by fund managers to suggest that investors focus on historic performance and as you know historic performance has benefitted greatly from bonds, property and shares becoming more expensive over the last 10 years or so.

What Mr Gregory might have meant was that investors shouldn’t focus on fees without looking at asset classes as well. Obviously over the long run an equity fund with high fees will probably outperform a cash fund with low fees. If that’s what he meant he should have said that.

It also obscures the fact that fees are paid in the total investment value, not on returns.

Lot's of questions about this!

You have said in the past you think that large pension funds are the best at investment decision-making.

So being consistent with this best practice, what simple tool would you like the FMA to publish for Kiwisaver investors to use to help make decisions?

I would have to think about that but probably the best advice I could give to the FMA would be to talk to people at the Super Fund so that they get an idea of what best practice looks like.

For a start I don’t think the Super Fund would repeat Mr Gregory’s ill-advised comment which amounted to advocating chasing short term returns. The Super Fund and ACC seem to be focussed on costs and the Super Fund indexes almost 90% of its share portfolio. Similarly I don’t think the Super Fund would share Mr Everett’s view that bad advice can be good advice if the institution with whom you deal can only provide bad advice. These are basic errors by the FMA and they need to acknowledge them and get their acts together.

Incidentally if I was publicly accused of being wrong and I thought I wasn’t I would defend myself. It’s interesting that the FMA stay silent on these issues. A judge once told me, informally, that if you are caught doing something illegal the best strategy is to say nothing.

Doomben, you say " So being consistent with this best practice, what simple tool would you like the FMA to publish for Kiwisaver investors to use to help make decisions?"

Do you work for the FMA, or MBIE? Just curious

Sign In to add your comment

| Printable version | Email to a friend |

This comment, if indeed he said it, is another major setback for retail investor outcomes. What he might have meant, being charitable, is that low risk funds with low fees aren’t necessarily the right thing but the industry will use this comment for their own purposes. Investors will chase performance just like they have always done and investor outcomes will suffer as a result.