Corporate Values, worth the effort?

"Communication. Respect. Integrity. Excellence." - Enron

Tuesday, August 14th 2018, 9:36AM

by Castle Point Funds Management

I once spent a day of my life that I will never get back, hashing out a set of corporate values for a previous employer.

The day was run by an external consultant who was an expert in such things, and I am sure was very expensive.

The room was large, windowless and stuffy and was filled with about one hundred of the company's "leaders".

The result of the day was a set of generic statements that sounded acceptable but didn't mean much to anyone. They were then announced with great fanfare to the masses, who were encouraged to learn them. Job done!

I then watched as senior members of the executive team acted contrary to some of these new values, and over time they were gradually forgotten.

More recently I met with the CEO of a company that we are researching, and he confided in me that, while there was some consultation with the executive team, the values were largely his.

He discussed how he had had to let some sales people go based on those values, even though it resulted in a risk of loss of revenues due to their industry connections.

When I met other members of the executive team they spoke of the company’s values and similar circumstances.

It is now standard corporate practice to have a set of values, but our experience is few executives could tell you why. And many would not be able to tell you what they were. Even fewer could recount a difficult decision that was made based on adhering to those values.

We have even encountered CEOs who could not recount them! In most companies, corporate values are a waste of the paper they are written on, but in a very few cases they can be extremely valuable.

The concept of corporate values was developed in the early 1980's alongside the concept of corporate culture and became widely known by the 1990's.

The concept of corporate values was developed in the early 1980's alongside the concept of corporate culture and became widely known by the 1990's.

In 1994 Jim Collins and Jerry Porras published the business literature classic "Built to Last", making the case that many of the best companies adhered to a set of principles called core values.

This resulted in a stampede by executive management teams to off-site meetings to conjure up some core values of their own. Today, most listed companies will publish a set of core values.

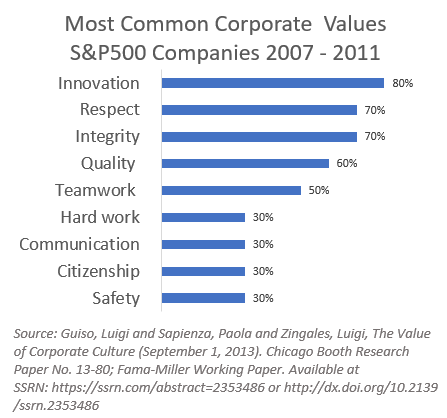

So, has this exercise been worthwhile? In 2013 Luigi Guiso, Paola Sapienza, and Luigi Zingales wrote a Fama-Miller Working Paper called “The Value of Corporate” (see http://ssrn.com/abstract=2353486 ), which found that proclaimed values did not appear to have any effect on a company’s performance.

However, when employees perceive top managers as trustworthy and ethical, the firm’s performance is stronger.

The authors used a dataset created by the Great Place to Work Institute. Rather than how corporate values are advertised by the firm, the database measured how values were perceived by employees.

This resonates with our experiences. If employees see a lack of commitment by an executive team to live by the corporate values, any worth in them is quickly destroyed.

Values define the culture of the business. The culture of a business is driven by the CEO.

It is reflected by who he or she hires and fires, and the principles expected of them.

This culture seeps through the business through staffing decisions and principles set by each following layer of management.

Click this link to see how Zappos does this in practice.

Asking about values is a good question to ask executive level management, as you can quickly work out whether you are dealing with an executive team that is just going through the corporate motions, or actually cares about the culture they are creating within an organisation.

If you can find a company that has a worthwhile set of corporate values, and lives them, it is a sign that it might be a gem.

| « Tariff Wars | The Big Risk: The Creditors' Revolt » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |