Housing affordability improves

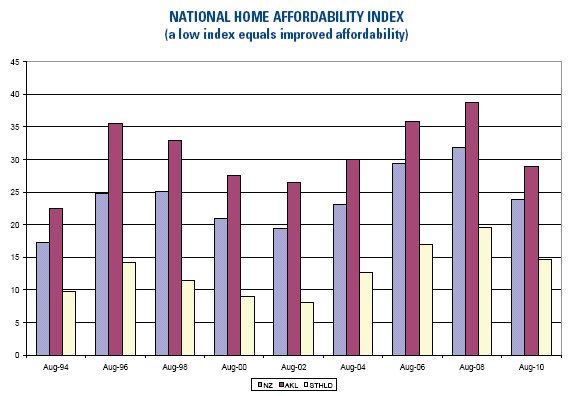

Housing affordability in New Zealand improved slightly in the third quarter of 2010 and improved almost 10% compared to the same time last year.

Tuesday, October 12th 2010, 12:00AM

by The Landlord

Massey University's latest Home Affordability Report shows the national affordability index improved by a small 0.8% in the third quarter and 9.7% on an annual basis, slightly down on the previous year's growth of 11.1%.

Housing affordability is calculated by comparing the affordability drivers, which are household income, median dwelling price and mortgage interest rates.

All three remained relatively subdued in the third quarter of this year, with the average weekly wage increasing $6.15 over the quarter, the median house price remained static at $350,000 and there was a 0.01% decrease in the average monthly mortgage interest rate to 6.59%.

"The housing market is currently characterised by very low turnover rates, expectations that mortgage interest rates will not increase very much in the short term and continuing low wage growth while the economy gradually recovers from the recession and the effects of the Canterbury earthquake," the report says.

On a regional level, seven out of 12 regions showed improvements in affordability for the quarter: Northland 6.4%, Taranaki 3.9%, Otago 2.5%, Hawke's Bay 2.3%, Auckland 1.7% and Nelson/Marlborough 1.3%. The other five regions showed reductions in affordability, with Waikato/Bay Of Plenty declining 3.8%, Canterbury/Westland 2.3%, Wellington 1.6%, Central Otago Lakes 1.3% and Manawatu/Wanganui 0.3%.

On an annual level, all regions showed improvement when compared to the previous year.

Regional annual improvements were led by Taranaki with 20.7%, then Otago 18% and Central Otago Lakes 16.7% in third.

However, Central Otago Lakes remains the least affordable region in the country, with an index of 141.2% of the national average, followed by Auckland's 121.1% and Nelson/Marlborough at 105.4% the average.

Southland retained its place as the most affordable region, with an index of 61.6% of the national average, followed by Otago in second place at 67.9% and Manawatu/Wanganui in third at 71.9%.

| « Momentum building in house market, according to ANZ | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |