Price rises not consistent

New Zealand residential property’s post-global financial crisis recovery has not been consistent, new data shows.

Friday, October 31st 2014, 12:00AM

by The Landlord

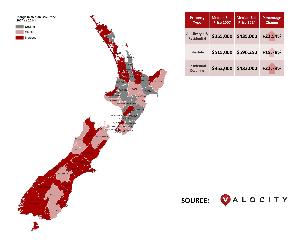

New property information service Valocity has released a map showing how regions of New Zealand’s current prices compare to their 2007 peak.

While all of the South Island has either been stable or seen a price increase over that period, big parts of the North Island still have lower prices than they did in 2007.

Coromandel, Whangarei, Waitomo, Ruapehu, Wairoa, Hawkes Bay, Tararua and South Waikato are among the areas where prices have dropped over the past seven years.

Managing director Carmen Vicelich said the Reserve Bank announcement yesterday that the official cash rate would be held for now would fuel the housing market.

“Dropped talk of future rate hikes will also fuel the property market, particularly in Auckland where we are seeing significant pockets of soaring house prices.”

But she said the trend for prices since the recession had not been consistent over the country.

“Auckland and surrounding areas are certainly reaching record highs and even surpassing previous peak values. Contrastingly though and somewhat alarmingly, some areas of New Zealand have not yet recovered since 2007 and continue to be in decline. The holding of interest rates should help these areas recover.”

Nationwide, the data showed all lifestyle and residential properties had experienced a median sale price increase of 22.54% over the seven years. Of that, residential prices increased 22.73% and lifestyle properties 15.78%.

Valocity is a New Zealand-owned property information, market insight and valuation service.

| « Healthy lifestyle property market: REINZ | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |