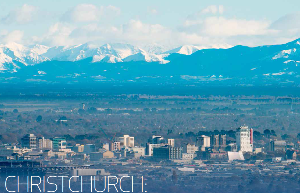

Christchurch: Before and After

Looking for new Christchurch hotspots? Pay attention to the new district plan.

Tuesday, December 2nd 2014, 4:24PM

by Amy Hamilton-Chadwick

Before and After

It’s a tale of two cities – pre-quake Christchurch and post-quake Christchurch. And nowhere is that more apparent than in the housing market. What was once a normal property market with smooth transitions in price as you travel further from the centre has become a market defined by levels of damage and technical categories.

With the central city and eastern suburbs worst-hit by the quakes, the less-damaged area to the north-west of the CBD has seen a boom in prices. From Mairehau to Hornby, prices have risen substantially, and are rising still. In fact, notes Tony Brazier, principal of Braziers, they are boosting values to the extent that they are counterbalancing some negative growth in the eastern and hillside/peninsular areas.

“Post-earthquake the north-west has boomed,” Lewis Donaldson, president of the Canterbury Property Investors’ Association and real estate agent with Harcourts Papanui, says. “The number of buyers has decreased, but the prices are still going north.”

This continued success has even surprised those in the industry. Peter Warren, franchise owner for Mike Pero in Christchurch, said August and September were especially quiet due to pre-election nerves of many investors and buyers. “But since the election, the market has sprung back to action. At this stage the market continues to gain although property sales were slower than previous months and have strengthened in October."

I’d say the huge spikes are out, and those wild statistics – the ones where everyone in the office says, ‘Oh my god, I can’t believe someone paid that’. But in general, the market has stablised at a healthy increase.”

Growth, not cash flow

North-west Christchurch encompasses a wide range of suburbs and types of housing, but in general it tends to draw good-quality tenants, who like the well-established heritage communities of the older suburbs like Fendalton and Merivale.

Perhaps the biggest drawcards in the northern and western suburbs are the schools; the importance of school zones for Christchurch families is hard to overstate. Many sought-after primary and secondary schools in this region are south after, particularly Christchurch Boys’ High and Christchurch Girls’ High – any property zoned for these schools will rent in a heartbeat, but comes with a price tag to match.

“Rental investors are well aware that if they buy in the north-west area they’re safe as anything,” Warren says. “Rents have stayed up where other places have dropped off.”

Although rents are relatively high, they’re not high enough to provide strong yields. Those who invest in north-west Christchurch now are looking for long-term capital growth, rather than impressive cashflow. Smart buying might secure you a yield of 7% to 8%, but anything higher won’t be available straight off the shelf, says Murray Ireland, owner and principal agent of Irelands Real Estate Agents and Property Management.

He predicts that rents will remain solid and stable into 2015, rather than rising, because there has been a definite increase in the availability of rentals across the city: “There are over 1200 rentals on TradeMe right now; quite a bit higher than at other times in the market when we’ve seen it range from 500 to 800.”

Family homes popular

Ireland says the biggest demand is still for three-bedroom family homes with double garages, though he adds investors should also keep an eye out for smart two-bedroom units, as these also prove popular with tenants.

You can occasionally pick up a unit for under $350,000, Warren says, though it will usually need a lot of work. For the more traditional family home, he recommends Burnside, where investors can buy a quality stone-clad family house for $400,000 to $500,000 and expect to rent it for $550 to $600 a week.

Donaldson says he also likes Burnside, as well as neighbouring Bishopdale, and he has a particular soft spot for Mairehau. “I feel it’s underrated,” Donaldson says. “There are good homes, but for some reason it goes unnoticed. St Albans is right next to it and it’s seen as central and affordable, but people don’t shop around in Mairehau as much.”

Donaldson, too, says that three- and four-bedroom homes are an investor’s best bet. He recently listed a “bog standard” 1960s three-bedroom home in Burnside, which he expected to sell for somewhere between $450,000 and $500,000.

Values almost tripled

Solid family homes are exactly what Andrew and Karen Hart have in their investment portfolio, and they’ve proved to be excellent investments. The Harts buy in such areas as Bishopdale, Harewood, Papanui and Redwood – “Ma and Pa homes, preferably built in the 60s and 70s, nothing spectacular,” Andrew Hart says.

The houses may not be spectacular, but the growth has been. The couple bought properties in 2004 for between $150,000 and $160,000, all with at least an 8% yield. The latest council valuations put those properties at around $410,000 to $440,000. They bought two more this year, one in Casebrook and one in Bishopdale, and found tenants for both before taking possession. The Harts are no longer buying for yield, saying that they are lucky to get 5.5% or 6% in the current market, but they now have a solid enough portfolio to support the lower cashflow properties.

“This area has been a good investment,” Andrew Hart says. “The reason we bought nice houses in good areas was to get good tenants, and we assumed that would help us through a downturn. That has come to pass.”

The solidity of the homes has been as advantageous as the solidity of the tenants: The Harts have mainly TC1 and TC2 properties, with a couple of TC3 properties, but none that required more than cosmetic repairs.

[Three technical categories, TCs, rate the predicted future earthquake performance of green-zoned land. TC1 is a low likelihood of future liquefaction damage; TC3 indicates that moderate to significant damage is possible. For more details check the Canterbury Earthquake Recovery Authority website, www.cera.govt.nz.]

The couple continues to keep an eye on the sales listings; their favoured suburbs are Bishopdale, Casebrook, Redwood, and possibly Hornby.

Property investor and developer Mark Revis also believes Hornby is a likely spot for further growth in this part of the city. He points to the mall, the major industrial developments and improved transport links as drivers for growth in Hornby.

If you’re looking for future hot spots, pay attention to the new district plan, he advises: “The new plan is changing a lot of the zoning, which means more intensive development, so underlying land values will go up. I’d look around some of the malls – like Northlands and Riccarton Mall – where the land value will rise. You’ll get good occupancy and capital growth, depending on how well you buy.”

Two-tier 2015 market?

The extreme volatility of the past few years may be gone from the Christchurch market, but it remains far from predictable. Brazier thinks buyers may begin to demand a higher standard of house, looking for clear evidence that a property was “vigilantly scoped, repaired professionally and signed off diligently”. These properties are hard to find, and new post-quake builds are likely to be a highly-sought after alternative. This has the potential to create a two-tier market of pre- and post-quake built houses, Brazier says, creating clear separations within the city.

Whether this happens, local investors have plenty to smile about. The long-term outlook for the north-western part of the city can only be improved by the roading system upgrades, new motorways and ongoing development. In addition, many local investors have some cash in their pockets and a wide array of choices when it comes to spending it.

“It has been estimated by the Chamber of Commerce that there is $4 billion to $4.5 billion of insurance pay-out money sitting in investors’ bank accounts waiting to find a home or to repair their properties with,” Brazier says. “What they choose to do with it this very expensive development environment will be interesting to see. The mix of money to spend and freshly repaired properties now being put on the market is a mix made in heaven for agents.”

Why invest in Christchurch?

Tom Hooper, CEO of the Canterbury Development Corporation [CDC], points to three main reasons property investors should continue to be confident in the Christchurch market:

1. Population growth: Unemployment is low and the region is attracting record levels of job seekers. Net migration is up and the population of Christchurch is forecast to be over 400,000 by 2026.

2. Limited housing stock: The CDC compares the number of houses lost in the earthquake with the population growth, and that analysis is showing an under-supply of houses at present. Considerable amount of building work is being undertaken, however, and this is likely to correct the shortfall within a year.

3. Strong economic growth: The rebuild continues and is “spread out over a longer time period than initially expected.” The CDC is no longer forecasting a ‘bust’ economy, which would have driven prices down, but is instead predicting “a period of easing following the rebuild-driven boom.”

“While the opportunity for investors to take advantage of the short-term capital gains created by the rebuild-driven property market in Christchurch has passed, the medium to long-term still looks bright for investors,” Hooper says.

Looking for property management in Christchurch? Try;

Irelands Real Estate Agents & Property Managers

| « Palmerston North housing’s big mover | Rents Firming in Gisborne » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |