Geopolitics aside, investors take long view with buying intentions

Economist Tony Alexander says despite geo-political upheaval and sharp declines in consumer and business sentiment, investors remain focused on the long term.

Thursday, June 6th 2024, 6:29AM

by Andrea Malcolm

This follows a May survey of more than 30,000 of his subscribers about their thoughts on managing their personal wealth.

Results show that despite the inherent risks to prices, investors continue to favour assets which can be affected by geo-politics as most have a long-term focus and events over the next one to two years are less of an issue.

The Sharesies-sponsored survey conducted had 947 responses, around 70% of whom are aged between 30 and 65. Respondents’ investment assets (including savings but excluding the family home) were less than $500,000 (28%), $500k-$2million (36%), $2m-$5m (22%) and more than $5m (14%).

The net proportion of respondents for the second quarter of 2024 who say they intend adding to their portfolio in the coming year remained steady at 75%; slightly down from 78% for the first quarter.

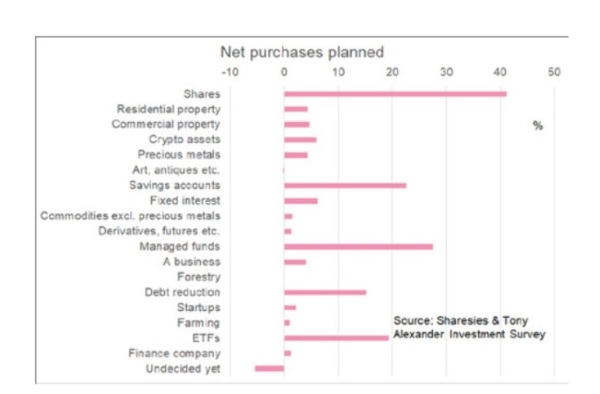

Asked about what assets they plan to buy more of investors favour shares (56%), managed funds (31%) and exchange-traded-funds (just over 20%). Residential property came in at 22% and reducing debt (16%) was also a target for those with spare funds.

For those thinking about selling assets, residential property (17.5%) and shares (just under 15%) are the top items.

“Putting the buy and sell measures together, we can get a feel for where net demand may be headed and theoretically this may indicate price pressures for various assets,” Alexander says in a report.

Not surprisingly shares, managed funds and ETFs still rank highly. The key asset which people have shown less and less interest in acquiring in the almost two year period that Alexander has been running the survey is residential property. In the latest survey net purchase intentions sat at just four per cent compared with 11 per cent a year ago and a peak of 17 per cent in September 2022.

Commercial property has also been trending down although over a longer period of time. This likely reflects the combined impact of interest rates, downward asset revaluations, and being able to secure stable tenants as the economy flat-lines, says Alexander.

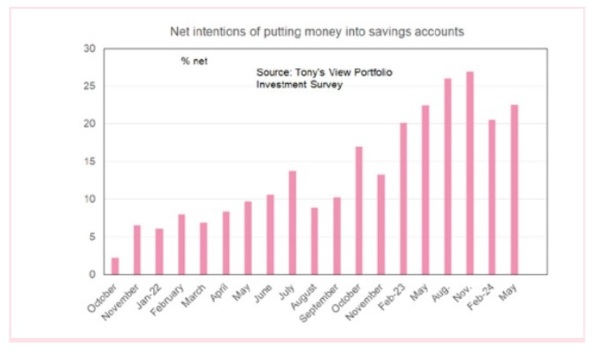

Earlier surveys in response to uncertain economic times, showed a firm rise in net intentions to park spare cash in savings accounts but this has eased over the last two quarters. Perhaps investors are responding to good price gains for other assets, says Alexander.

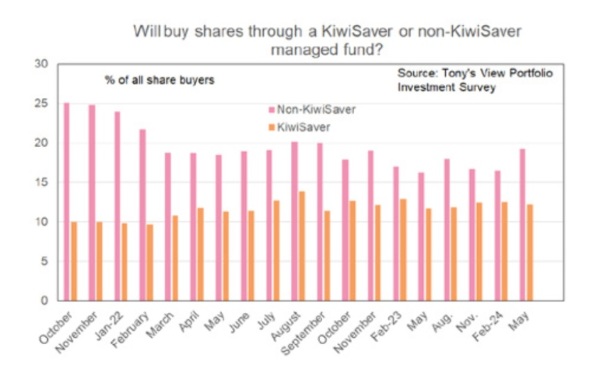

The strong preference of investors was to buy shares directly or through a broker (45%). This was followed at some distance by ETF investment (20%), managed funds (19%) and KiwiSaver (13%).

However, willingness to gain exposure through managed funds and KiwiSaver appeared to be tracking upwards again.

| « Castle Point sold | Kernel passes milestone, onboards advisers wanting KiwiSaver for accumulators » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |