Investment in unethical businesses falling

According to the Financial Markets Authority, around 90% of investment is now being managed with some form of ESG overlay.

Tuesday, October 1st 2024, 6:07AM

by Andrea Malcolm

As KiwiSaver hits $111 billion in funds under management, that’s $100 billion of KiwiSaver funds, FMA general counsel LIam Mason told attendees at the Responsible Investment Australasia Association NZ last month.

ESG and ethical investment aren’t the same, as outlined by Pathfinder’s John Berry. An ESG rating doesn’t measure how a company contributes to a better society and environment but how environmental, social and governance issues could pose a significant risk to a company’s bottom line.

For example British American Tobacco, last year, scored 81 out of 100 in the 2023 S&P Global Corporate Sustainability Assessment, and has been included in the DJSI European Index 22 years in a row.

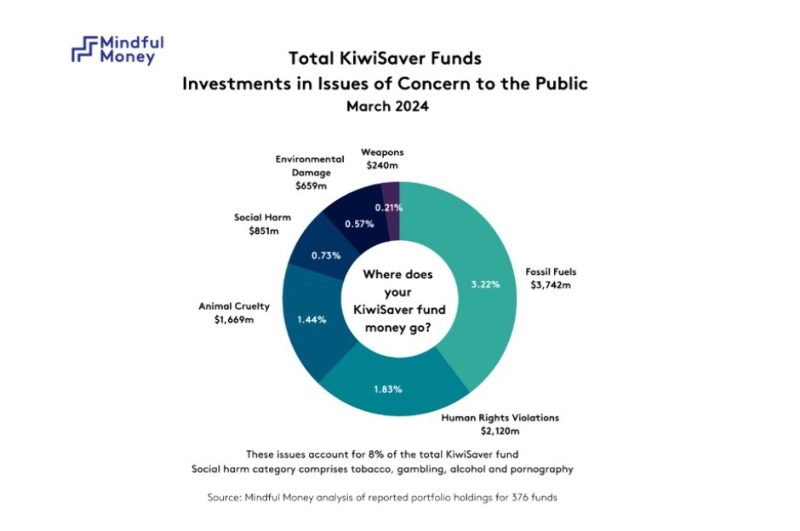

However the positive news is that ethical investing website Mindful has tracked significant changes in the proportion of investment in unethical issues of KiwiSaver and managed fund investment, over the past six years.

These include a 74% fall in investment in tobacco products, a 33% fall in alcohol, 20% less going to gambling, a 69% fall in pornography and adult entertainment, a 31% fall in weapons, a 29% fall in animal cruelty and a 16% fall in environmental damage

All promising signs that the investment sector is starting to shift gears, says Coates.

“For example, KiwiSaver investments in nuclear weapons have plummeted from over $100 million in 2019 to $13 million currently, despite a huge increase in overall KiwiSaver funds.

“The investment providers are getting the message that their clients don’t want their money to be invested in making nuclear weapons. As a nation, we've long stood against nuclear weapons, and now our investments are starting to reflect our values."

Despite the progress, there is still $9.3 billion of KiwiSaver investment in harmful activities.

Mindful Money has drawn a list of companies of concern from ratings agencies and public sources, including the Norwegian Sovereign Fund, NZ Super Fund, Sustainalytics and research organizations.

“Some fund managers are too focused on short term returns. Examples are increased investment in the world’s worst oil and gas companies when oil prices rose after

Russia invaded Ukraine, or investments in weapons companies that have profited from bombing in Gaza.

“In the long term, there is evidence that ethical investment returns are at least as high or higher than conventional investing. Chasing short term returns, by investing in harmful activities, is unethical and against the wishes of most investors. It is also financially risky, relying on fund managers believing they can time the rises and falls of financial markets,” says Coates.

“Transparency is a wonderful thing. When investors see where their money is invested, and understand that it is easy to switch funds, they are making informed choices. There has been a significant rise in people switching their investments towards funds that demonstrate that they care about ethical issues as well as good returns.”

| « RIAA aligning climate standards across borders | Asset managers shy away from ESG label under Trump » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |