Tower: Commodity Investing in 2009

We live in stimulating times, writes Michael Coote CAIA, National Manager Mezzanine Clients, TOWER Investments

Friday, June 5th 2009, 1:43PM

by Michael Coote

If 2008 was the year of financial markets crises, then 2009 has shaped up to be the year of economic crisis. In response numerous governments and central banks have launched massive economic growth stimulus packages. Beneficial effects from fiscal stimulus by governments and monetary stimulus by central banks will take time to become more noticeable. In the meantime statistical reports suggest that at least the rate of economic downturn is decelerating. Quantitative easing stimuli (colloquially known as “printing money”) undertaken by key central banks such as the US Federal Reserve, the Bank of England, and the Bank of Japan are beginning to work as planned.

An early sign of economic stabilisation has been an uptick in prices for some commodities. This improvement is partly attributable to increased buying by manufacturers re-stocking unusually low goods inventory levels and China’s demand for raw material inputs into ambitious construction and infrastructure projects funded by its $US586 billion fiscal stimulus programme. Once sustainable economic growth is underway again, commodity supply bottlenecks should re-emerge. The global economic crisis has caused commodity producers to scale back, postpone, or cancel previously planned investment in expanding production capacity. Supply restrictions will eventually exert more influence on commodity price trends.

Commodities as an economic growth bellwether

Commodity prices will continue to provide important signals regarding global economic recovery. Reasons for this signalling function include:

• Prices reflect actual demand and supply for commodity inputs into the real economy wherein physical goods are produced and consumed

• The market for commodities is truly global because all economies bid for them competitively.

Apart from real economy demand and supply, commodity prices can be positively influenced by other factors such as inflation – particularly if unexpectedly high - and market shocks like labour unrest, political tensions, and outbreaks of war or disease. Market commentators have warned that central banks are creating preconditions for higher future inflation by unleashing vast expansions of money supply through quantitative easing and other emergency economic and financial market rescue plans.

If so, commodities should benefit because they are inflation hedges (ie., commodity prices tend to rise with increasing inflation). One useful measure of trends for commodity prices - and thereby the direction and momentum of global economic growth - is the Dow Jones-AIG Commodity IndexSM (currently in the process of being renamed the Dow Jones-UBS Commodity IndexSM).

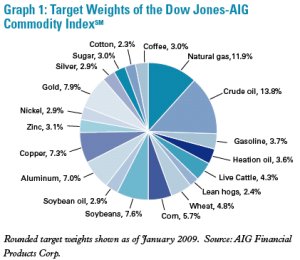

This index tracks the 19 commodities most important worldwide as demonstrated by high levels of:

• Commodity futures market liquidity, reflecting large amounts of trading activity

• Physical production as valued in $US Index weightings are shown in Graph 1.

Rebalanced each January, these weightings are intended to ensure index diversification without any particular commodity being over-represented (eg., crude oil) or under-represented (eg., gold).

As Graph 1 shows, the 19 commodities are a much diversified group, but they can be divided up into three broad categories containing various sectors:

• Energy category (sector: petroleum)

• Metals category (sectors: precious, industrial)

• Agrocommodities category (sectors: agriculture, livestock)

Price trend analysis

Table 1 assists with observing and analysing price trends displayed by this core sample of commodities. Every commodity listed except gold is down by double digits for the year to April 30, 2009. Consequently the Dow Jones-AIG Commodity IndexSM is off by nearly one half its level of a year ago. This substantial price reduction could well be described as the global economic stimulus package delivered by commodity markets. In particular, because the price of crude oil is interpreted by economists as a de facto tax on importing countries, an oil “tax cut” of about 70% has occurred. Similar “tax cuts” have been provided by 17 other commodities listed.

The one exception – gold – was boosted by flight-to-safety panic unlikely to continue as appetite for riskier investment returns to financial markets. Year-to-date returns for commodities show some moving into positive territory, a trend most marked in the agriculture sector. The surge of price increases widened in April to include industrial metals. Continuing softness in most energy category commodities has been supportive of economic stabilisation. Weakness in precious metals was indicative of greater investor risk appetite revealed in rising sharemarkets.

Investing in commodities Commodities generally represent cheap buying at present, notwithstanding some price improvements over recent times. Emerging economic demand, existing supply bottlenecks, and prospective return to rising inflation argue for an allocation to commodities in most growth investment portfolios. Moreover, commodities have excellent diversification benefits when combined with other asset classes such as shares and bonds.

The TOWER Global Commodity Fund is an established commodity fund option featuring:

• Continuous exposure to investment returns from the widely diversified, annually rebalanced Dow Jones-AIG Commodity Index Total Return IndexSM

• Daily fund liquidity

• Ability to increase or decrease portfolio allocation to commodities at the sole discretion of investors or their advisers

• NZ dollar-denominated PIE structure subject to Fair Dividend Rate (FDR) rules

• Underlying management by major US bond manager PIMCO

For a copy of the investment statement and further information on the TOWER Global Commodity Fund, please contact your investment adviser, call TOWER on 0800 808 808, or visit www.tower.co.nz.

Note: The Dow Jones-AIG Commodity IndexSM is an excess return index representing the 19 commodities categorised under sector sub-index headings in the table. The Dow Jones-AIG Commodity Index Total Return IndexSM is the Dow Jones-AIG Commodity IndexSM passively collateralised by US Treasury bills. All sector sub-indices and individual commodities reported for excess returns only. Source: TOWER Investments

| « Infrastructure - Having you cake and eating it too | AUSTRALIA Series 1 - Accessing an Australian equity recovery » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |