Loosened LVRs push up mortgage lending

Part of the early-stage recovery in the housing market comes from loan-to-value ratio rules being loosened in June.

Friday, September 29th 2023, 12:14PM

by Sally Lindsay

The latest RBNZ data shows there was $5.8 billion of gross mortgage lending in August, up by $0.4 billion from a year ago.

As part of this CoreLogic says banks’ interest-only lending remains ‘under control’, with about 36% of loans to investors in August being done on this basis, compared to a cyclical peak of 46% in July/August last year, and a figure of only about 14% for owner-occupiers, compared to about 20% a year ago.

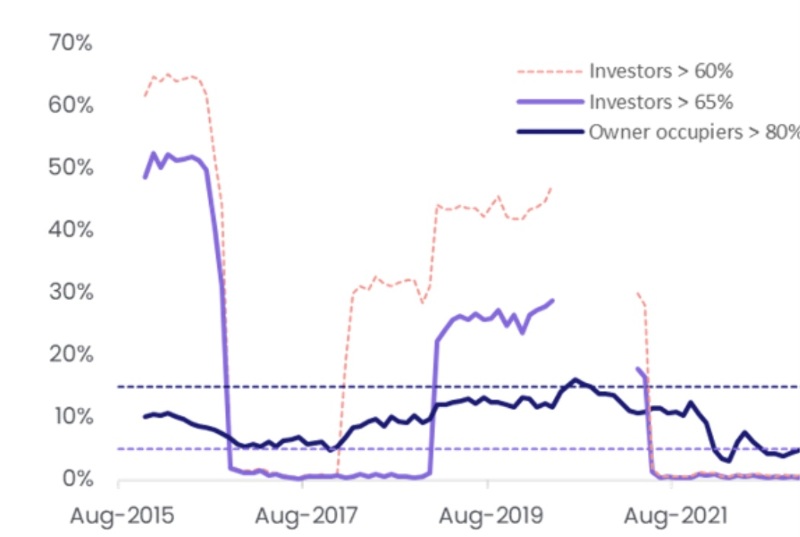

Perhaps the most interesting cut of these figures, however, says CoreLogic is the breakdown by loan to value ratio (LVR), which showed that lending to investors who don’t have the required 35% deposit – unless going new-build – remains almost non-existent.

By contrast, given the relaxation of the LVR rules, the past few months have shown a sharp rise in the share of lending to investors with a 35-40% deposit – a group precluded by the previous LVR settings.

Percentage of lending at high LVR (Source: RBNZ)

CoreLogic’s chief property economist, Kelvin Davidson says it’s also worth reiterating that overall investor lending flows remain subdued, and their purchasing activity in the market is also still fairly muted. In other words, those investors borrowing with a 35-40% deposit (or 60-65% LVR) may be topping up existing loans or switching banks, rather than actively buying more properties.

“Similarly, low-deposit lending to owner-occupiers has also risen lately, from about 6% of activity in May to 8-9% now – still below the new 15% speed limit, but nevertheless the highest share since late 2021. In turn, a high share (around 75%) of those low-deposit flows for owner-occupiers is actually absorbed by first home buyers.”

The RBNZ also contained the latest update to the newly-published breakdown covering ‘loan purpose’. These figures show top-ups and bank switches have remained relatively stable in the past few months, but house purchase loans are showing early signs of an upturn.

Davidson says the latest mortgage lending figures add to other evidence that the housing market downturn has all but ended, helped in part by the loosening of the LVR rules and also relaxed CCCFA rules one month before that.

“However, we’re cautious about the speed and scale of any near-term rebound in property sales, lending volumes, or house prices. Mortgage rates aren’t likely to fall significantly anytime soon – maybe not for at least another year – and the serviceability test rates remain a key hurdle for many would-be borrowers. High mortgage rates have recently been a key factor limiting the size of loans in relation to incomes, given they restrict how much debt that can actually be serviced from a given wage.

“On that note, we still think there’s a reasonable chance that formal caps on debt to income (DTI) ratios will be imposed by the RBNZ next year. To be fair, given that high DTI lending has already fallen, formal caps may not actually do much straightaway.

But if imposed, they’d mean the RBNZ is already ‘ahead of the curve’ for when interest rates do eventually fall again and possible financial stability risks from larger new mortgages re-emerge.”

He says in the long run, DTIs will tend to tie house prices more closely to incomes, which grow slower than the historical rate of house price inflation the country has seen over the past 20-30 years, and also limit the number of properties that anybody can own until there’s been sufficient time – maybe five to seven years – for their incomes to grow enough to allow the next purchase.

| « New Zealand’s next top town | The tax benefits of a new build » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |