What if the government had paid down debt instead of investing in the NZ Super Fund?

The NZ Super Fund, which turned 20 in September, has returned 9.75% per annum since its inception.

Thursday, October 26th 2023, 6:31AM  1 Comment

1 Comment

by Andrea Malcolm

During its life, it has made $41.6b more in investment returns than the government would have saved in interest by paying down debt. Of that amount, $4.7b was generated in the 12 months to June 2023.

For the year 2022/23, NZ Super gained $9.7b to total $65.4b – a pre-tax return of 11.87%, thanks to the strong recovery of global equities in the second half of the reporting period. That saw it maintain its status as top performing sovereign wealth fund in the world over the past decade according to the sovereign data platform Global SWF.

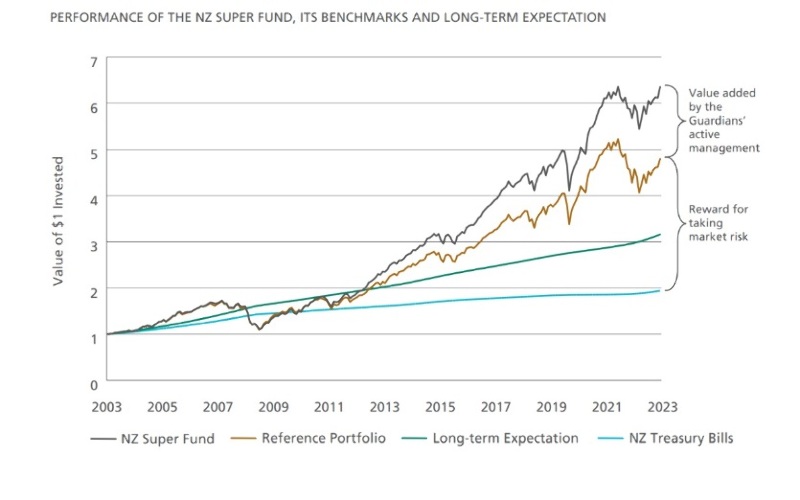

Outperforming the government’s cost of funding is one of two key benchmarks used by the fund’s Guardians to measure investment success.

The other is the return compared to its reference portfolio, a shadow portfolio of passive, low-cost, liquid investments (75% equities, 5% NZ equities and 20% bonds) suited to its long term investment horizon.

In the annual report the Guardians note that strong performance from some active investments, in particular the internally managed strategic tilting strategy, was offset by weaker results in others meaning it underperformed the reference portfolio.

This year’s 0.16% underperformance compares with the long term target of 1% outperformance and 1.5% outperformance since inception. It is also in contrast to last year’s substantial outperformance which returned 1.69% in value.

The reference portfolio is the single biggest influence on NZ Super returns, because it dictates the overall level of market risk the Guardians are willing to take on. “In practice, the Net Asset Value (NAV) of our reference portfolio comprises just under half of our actual portfolio, with active investment strategies making up the balance.”

About 29% of the actual portfolio is managed internally and around 20% is active equity. Taking advantage of its long investment horizons and Treasury expectations that withdrawals won’t start until the 2030s, one of the most successful active stareties has been strategic tilting, the report says. This is guided by the belief in mean reversion in asset prices and uses derivatives to take contrarian positions across a number of investment markets.

For the past year strategic tilting and tactical credit, which provides liquidity into private markets, have added significant value – $935m in value-add, representing the fund’s largest contributor to value-add since inception of around $4.6b.

Perhaps there is an implied message to the new government not to mess with the NZ Super Fund in the section of the report on cumulative net contributions. It notes that in the next 50 years, the fund is expected to become an increasingly important asset for the government. Based on Treasury modelling it will increase in size from about 16% of GDP to 37% and tax paid to the crown will make up around 0.6% of GDP and the tax paid will increasingly offset government contributions. Treasury estimates that by 2033/34 when the withdrawals to pay for universal superannuation begin, the government would have contributed $6.9b (less than the current net contribution of $15.5b) and the fund will be worth more than $133b.

Sustainable finance

Following the new climate related reporting rules introduced by the Labour government, the NZ Super Fund also released its first Climate Change Report describing climate change challenges and its investment approach and a 2023 Carbon Footprint.

In 2016 it developed a climate change investment strategy with the aim of reducing the carbon intensity in its portfolio 40% by 2024 and fossil fuel reserves 80% by 2025. In 2021 the Guardians committed to achieve net zero carbon emissions by 2050.

The guardians view ESG considerations necessary to best practice investing, and that climate change is a material risk to long-term investors, the report said.

The first phase of the fund’s RI strategy reset was completed and integration of sustainable finance into the investment process is business as usual. At the beginning of the reporting period, the fund switched to the MSCI World Climate Paris Aligned Index and MSCI EM Climate Paris Aligned Index benchmarks for the global equities component of the reference portfolio and the ESG profile of the factors mandates now make up around 20% of the fund’s portfolio.

Local investment

Around 12% of the fund or $7.5b is invested in NZ assets.In 2009, the then finance minister Bill English directed the Guardians to look at increasing allocation of NZ assets. While the value of NZ investments has grown by around $5b since that directive, the percentage as a proportion of the portfolio has decreased 3% over the past year, or 10% since 2009.This is due to relative growth rates and market size of NZ compared with global asset classes.

The fund is allocated to NZ shares through two active and one passive internal investment mandates and two active local managers Devon Funds Management and Mint Asset Management.

| « Shanks stays in industry but moves to Oz | JMI Wealth expands into Waikato with buyout » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

Or bitcoin?