NZ Super a taonga we can afford as is - retirement commissioner

Claims NZ Super is unaffordable aren’t borne out by independent analysis, says the Retirement Commission.

Friday, February 16th 2024, 6:21AM  2 Comments

2 Comments

by Andrea Malcolm

In the lead up to the Super Sumit in Wellington on March 21, retirement commissioner Jane Wrightson says there needs to be an evidence-based discussion about policy options and the impacts of any change.

“Tomorrow’s pensioners will not be in the same position as today’s. We need a way for politicians to take a longer-term, and purposeful approach, so the right decisions are made.

“At the very least, the number of parties who have made a political commitment under the New Zealand Superannuation and Retirement Income Act 2001 could be expanded.

“This would signal their ongoing commitment to current policy settings and impose special obligations on the Government to disclose whether consultation has taken place with other listed parties and the results of the consultation.”

In a new report the commission says general political discussion over the years has tended to focus on claims of unaffordability without independent, publicly accessible analysis that includes a wide strategic lens. A longer-term political accord, and the process to reach it, would assist debate and balanced decision-making.

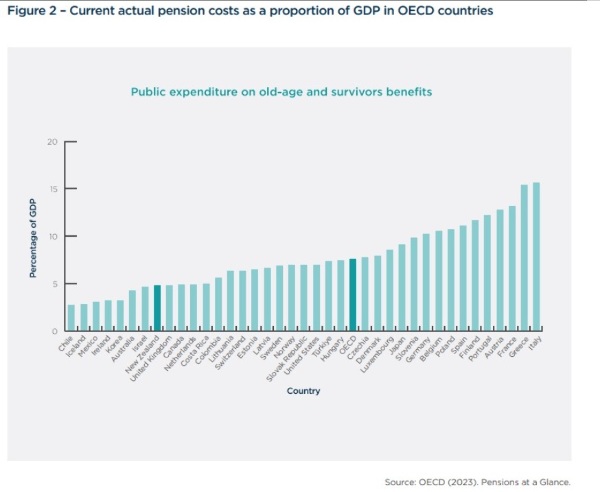

The report says NZ is actually the eighth lowest pension spender in the OECD as a proportion of GDP and is funded without tax revenue streams, such as capital gains tax or wealth tax, that are common overseas.

Wrightston says our expenditure would continue to be well below the OECD average in 40 years without any change to the age of eligibility.

“The current age of eligibility for NZ Super is not low relative to other OECD countries, with 70% currently having a pension age of 65 or below, reducing to 53% by the 2060s.”

In line with earlier analysis by the Society of Actuaries retirement interest group, the Retirement Commission recommends no change in eligibility age to prevent a disproportionate disadvantage to manual workers, carers and those with poor health.

Otherwise the extra cost of supporting some people through to a later age would reduce the fiscal savings made from raising the age.

As at 30 June 2023, 883,239 people were receiving NZ Super and 5,136 were receiving a veteran’s pension. The majority (82.9%) identified as European, 7.1% as Māori and 3.4% as Pacific people.

The report says the universal design feature of NZ Super removes stigma and is simple to administer. Treasury data shows it cost the Ministry of Social Development (MSD) $69 million to administer NZ Super (including international social security entitlements and agreements) in 2023-24.

“Against an expenditure of $21.6bn in the same year, that is a percentage cost of just 0.003%.”

Testing

The report said if fiscal savings for NZ were to become essential, income testing to exclude those who earn ‘significant’ income, perhaps twice the median income, would be an option.

Stats NZ data for Q2 2023 show around 66,600 men (52% of the population) and 58,900 women (43%) aged 65-69 years remain in paid work.

Meanwhile IRD data for the 2021/22 financial year shows 33% of superannuitants (270,564 people) had taxable income over $30,000 and 6% (49,368 people) had taxable income over $100,000.

The report says people who receive income from investments, rather than earnings, would be impacted to the extent their income was above the income-test. Under this option, assets would not be considered as part of the test for eligibility.

The downside would be that income testing introduces design and administration complexity for MSD and requires liaison with IRD.

| « Trustees seeking refuge in PIEs could weaken our capital markets | AMP's NZ arm lifts profit despite » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |