Why the Govt says no to tax incentives

Treasury releases a report it wrote to Finance Minister Michael Cullen explaining why tax incentives for health insurance don't work.

Tuesday, March 5th 2002, 10:56PM

Executive Summary

Interest in subsidising private health insurance in New Zealand has been raised over the last year by the Health Funds Association (HFA) of New Zealand, which represents health insurers. The association has commissioned a report from the New Zealand Institute of Economic Research (NZIER), which argues for tax credits for people who have health insurance.

On a number of occasions you have stated your opposition to the idea of tax relief for those with private health insurance. You may be interested in our modelling to estimate the fiscal costs and benefits of subsidising insurance, based on figures contained in the NZIER report. Whatever the arguments in support of tax relief, we consider that any proposed insurance subsidy falls at the first hurdle if it cannot ‘break even’ from the Government’s perspective. Our modelling shows that it cannot do this, because the majority of the total subsidy is simply a transfer to people who would have had health insurance anyway.

The cost of subsidising private health insurance is the rate of the subsidy multiplied by the total value of premiums. All policyholders will benefit from the subsidy, whether they are existing members or new members.

The fiscal benefit of subsidising private health insurance is the reduction in demand on the publicly-funded health system caused by an increased number of people with health insurance. People with insurance place few, if any, demands for elective surgery on the public health system. An additional $1 spent on health insurance premiums would not reduce the pressure on the public system by an equivalent $1, however, since:

- private insurers are likely to have higher overhead and administrative costs;

- privately-financed health care is generally more expensive than publicly-financed care;

- in many cases, health insurance buys different services than those offered in the public system, so does not directly reduce demand on the public system (e.g., GP co-payments and varicose vein surgery).

Thus, an additional $1 spent on health insurance premiums would reduce the pressure on the publicly-financed system by less than $1 (call this $p, where 0<p<1).

Whether a subsidy on private health insurance ‘breaks even’ from the Government’s perspective depends on how people respond to lower insurance premiums. The NZIER report claims that the price elasticity of demand for health insurance is –0.54: a 10% reduction in the cost of premiums, for example, would result in a 5.4% growth in the number of people covered.

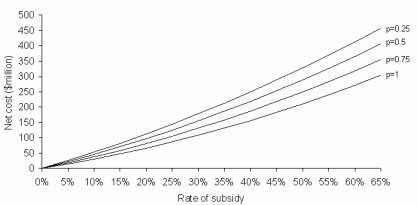

At this elasticity, a health insurance subsidy will always result in a net loss to the Government (Figure 1). For example, a 30% subsidy (such as exists in Australia) would cost $202 million. The benefit of this subsidy in terms of reduced demand on the publicly-funded system, even under the most favourable, and unrealistic, assumption that p =1, only comes to $94 million. The net cost (cost minus benefit) is therefore $108 million.

At lower values of p, the net cost of subsidising health insurance increases. Under the assumption that p =0.25, a 30% subsidy would have a net cost of $178 million.

Figure 1. Net cost of subsidising health insurance for different values of p, assuming elasticity of –0.54

Note: this model assumes that 1.6 million people in New Zealand are currently covered by health insurance and that the average cost of a premium is currently $360 per person covered. These figures are sourced from the NZIER report.

Note: this model assumes that 1.6 million people in New Zealand are currently covered by health insurance and that the average cost of a premium is currently $360 per person covered. These figures are sourced from the NZIER report.

The model is also insensitive to reasonable assumptions about the price elasticity of demand for insurance. Even with an elasticity of -1, rather than –0.54, a subsidy on health insurance would always result in a net loss to the Government.

The NZIER report claims that the net cost of subsidising health insurance would be lessened by:

- taking into account the indirect benefits of an increased uptake of health insurance such as the reduction in lost working days as a result of earlier treatment;

- targeting the subsidy at households with low incomes.

Little evidence is given for NZIER’s claim about indirect benefits. In any case, whatever indirect benefits would be created by an increase in insurance coverage need to be balanced against the benefits foregone by making a net loss on the subsidy. In the 30% subsidy illustration given above, for example, whatever indirect benefits accrue from an additional $94 million of expenditure on health insurance would be overwhelmed by the indirect benefits foregone by spending $202 million on the subsidy. It would be better to spend the money directly on the public health system.

It is also doubtful that low-income groups would respond to a price incentive more eagerly than the population as a whole. While low income households tend to be more price sensitive in general, it is questionable whether health insurance, even if it was subsidised, would be a priority purchase from a limited budget. Elderly low income people (who are high users of the public system) face a double affordability barrier, since health insurance premiums are much higher for people aged over 65 years.

Recommended Action

We recommend you note that the cost of subsidising private health insurance would far outweigh the fiscal benefit in terms of reducing demand on the publicly-funded health system.

This is a report produced by Treasury

| « HFA opposes rating health insurers | Mixed reviews from advisers on FMA regulation » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |