How housing affects the market for insurance

Why would the housing market be a factor in underinsurance? Russell Hutchinson explains.

Monday, June 29th 2020, 7:53AM

According to the Ministry of Housing and Urban Development, in 2018 there were 291,000 households that were either severely deprived, in public housing or were spending more than 30% of their gross incomes on rent.

Probably, the "severely deprived" aren’t the target market for insurance anyway.

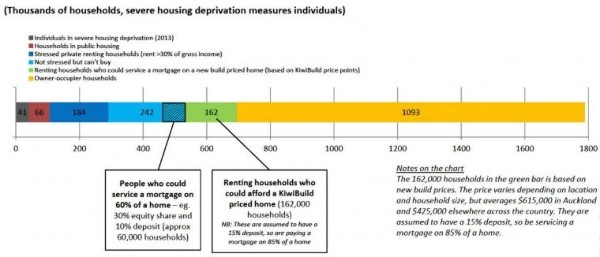

The chart below comes from that report.

It shows that there are about 184,000 renting households that are spending more than 30% of their income on housing.

That 30% figure is a reasonably well-established international guide to budget stress due to high housing costs.

What the chart doesn’t show is how many of the homeowners are under similar stress – as this chart is all about people who might want to buy a house, and why they might be finding it hard to save up a deposit.

The most recent reporting available from the Ministry of Social Development shows that 29% of homeowners were spending more than 30% of their income on housing.

That’s about another 330,000 households.

Add them up with the stressed renters and you get over 500,000 households with budgets stressed by housing costs: spending more than 30% of their income just on that one line-item in the family budget.

Anyone who is really struggling to pay for housing, probably won’t be buying insurance.

When this proportion was lower than the proportion of the population that was not in work, I used to assume rough equivalence. No more.

Today we know that some households will be homeowners that will be stressed even if every adult in the household is in work.

It’s what the economists call a headwind, and it's real.

That was back in 2018.

There has been no massive supply-side shift for housing – we could do with a few more being built – and in the meantime there has now been a shock to incomes thanks to Covid-19.

It is worrying to think of the stress for those in travel, tourism and hospitality in an already stressed housing market.

Of course, if some stimulus spending were directed at building houses, it could help a lot – but only very slowly – because people that bought houses last year, have budgets based on what they paid, not what houses are worth now.

| « Ways to sell more insurance | Should we be warning consumers about IP prices? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |