Insurance industry complaints on the rise

The latest Insurance and Financial Services Ombudsman Scheme Annual report has been released showing accepted complaints have increased by 25% across the insurance industry.

Friday, September 10th 2021, 1:46PM  3 Comments

3 Comments

by Matthew Martin

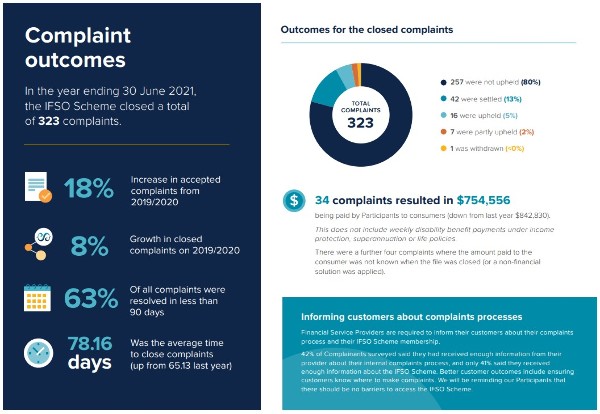

Insurance and Financial Services Ombudsman (IFSO) Karen Stevens says most complaints this year were about insurance, with an 18% total increase in complaints accepted by the IFSO.

Stevens says the lift can be attributed to growing consumer awareness of the Financial Markets Authority's focus on conduct and culture, as well as the Insurance Council of New Zealand's Fair Insurance Code.

Overall, complaint enquiries were down 8% from the year before, from 3922 in 2020 to 3626 in 2021.

However, total accepted complaints went up by 18% in 2021 with 334 complaints accepted compared to 274 in 2020 but were up 25% across the life and health and fire and general insurance sectors.

In the health and life sectors, 105 complaints were accepted (see breakdown below) with 33 complaints about life insurance, 24 for health and 22 for income protection.

199 complaints were accepted in the fire and general insurance sector, the bulk of those (63) were for motor vehicle claims, 49 for travel claims and 45 for house insurance claims.

Stevens says some complaint issues remain constant.

“Consumers often don’t understand what the policy covers and how exclusions can cut out the cover they thought they had.

"People must carefully read what is on offer. This ensures the policy they are buying is the policy they need.”

She says complaints often reflect a misunderstanding of insurance terms, however, she says most providers are “quick to resolve and settle complaints when we contact them, which demonstrates a mature level of customer service".

Stevens says with covid, climate change, increasing natural disasters, cyber-security threats and regulatory changes the industry is having to respond quickly to many changes.

IFSO Scheme Commission chairperson Sue Suckling says the 2020/21 year has been demanding with the ongoing uncertainty associated with covid, system changes and pressures.

"New regulation and controls are underway for financial service providers, and the global focus on improved conduct and culture has impacted all participants," says Suckling in the report.

"This year, the IFSO Scheme received a surge in complaints, and our specialist team worked hard to maintain complaint closure rates."

She says resolution times were extended beyond set benchmarks.

"Mindful of the severe business disruption caused by the global pandemic, the Commission has not increased participant levies in the past two years.

"Anticipating the compliance burden faced by financial advice providers with the implementation of FSLAA, the Commission approved a restructure of annual levies for the advice sector that saw a reduction in the standard adviser levy rate, with volume discounts," she says.

Accepted complaints in the health and life sectors:

Life: 33

Health: 24

Income protection: 22

Trauma: 15

Mortgage/Loan/Credit card protection: 11

Accepted complaint issues in the health and life sectors:

Policy exclusion: 20

Non-disclosure: 18

Premiums: 17

Scope of cover: 15

Misselling/Misleading info/misrepresentation: 13

Pre-existing condition: 10

Prima facie claim: 7

Reasonable decision: 4

Policy limits: 2

Interpretation of contract terms: 3

Customer services issues: 2

| « Asteron Life support businesses with premium relief options | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

Further: Stevens says the lift can be attributed to growing consumer awareness of the Financial Markets Authority's focus on conduct and culture, as well as the Insurance Council of New Zealand's Fair Insurance Code.

Oh really?

These same consumers who "often don’t understand what the policy covers and how exclusions can cut out the cover they thought they had"... DO understand CoFI and ICNZ code? LOL

Overall complaint numbers were down, even while complaints accepted went up. This is good news really - it means the Karens had better things to do (than complain to IFSO).

https://s3.ap-southeast-2.amazonaws.com/ifso-files/docs/IFSO-Scheme-Annual-Report-2021-webversion.pdf?mtime=20210908091430&focal=none

of the 334 complaints accepted, 9 were against Financial Advisers.

9.

Number of Advisers in the IFSO scheme: 1889

What we can't see is how many were upheld, and what sector those advisers came from.

Sign In to add your comment

| Printable version | Email to a friend |