Minister says no commission ban

Commerce Minister Paul Goldsmith says banning commissions isn't something the government will do, even though the FMA says they create problems.

Wednesday, June 29th 2016, 1:00PM  2 Comments

2 Comments

Goldsmith told the Financial Markets Law conference in Auckland today that commission had been looked at as part of the review of the Financial Advisers Act (FAA).

While banning commission was an option, as it has been done in other jurisdications, the government has decided not to go that far.

"Effective disclosure is more important," he said.

While he could talk about potential changes proposed in the FAA review, he said a goal was to "weed out conflicted behaviour."

Goldsmith said he expects to take a paper to Cabinet next week on changes to the Financial Advisers Act.

He says the current FAA was expensive and confusing for consumers and inconsistent.

Also the act didn't cater for roboadvice.

IFA president Michael Dowling said "I don't believe you can eliminate conflicts."

Rather advisers and organisations needed to identify potential conflicts and manage them. The best way to do that is by being transparent, he said.

Meanwhile the FMA says it will "produce further guidance for financial advisers on how to ensure they are putting their customers at the heart of what they do."

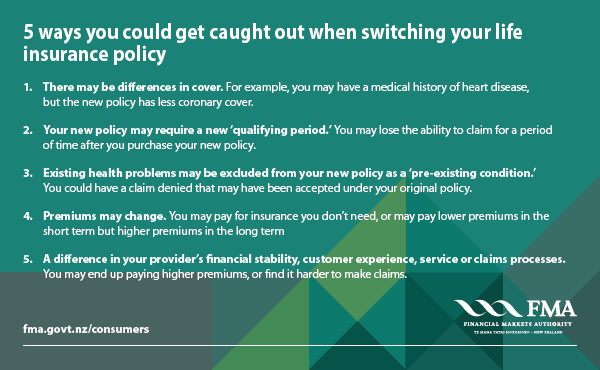

Also it has developed resources for consumers to help them to make better-informed decisions when buying or replacing life insurance.

| « Kiwi company attracts $200 million global investment | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

If there are indeed improper inducements, the FMA should be turn their considerable powers on the drug-pusher, rather than the drug-taker.

Good call Mr Goldsmith.