New accounting standards = more costs for insurers

Kiwi insurers are set to face more compliance costs when the latest international-level accounting standards come into effect at the end of this year.

Monday, November 1st 2021, 10:18AM

by Matthew Martin

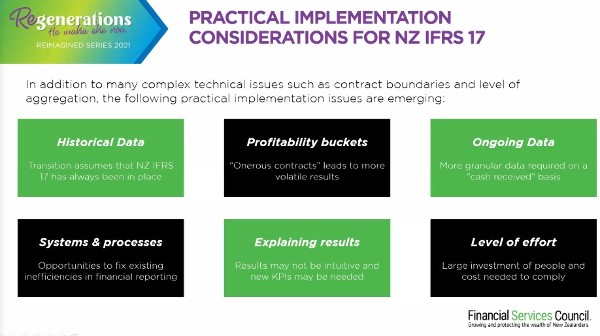

According to actuarial services team leader and partner at PwC New Zealand Ben Coulter, the introduction of New Zealand International Financial Reporting Standards 17 (NZ IFRS17) will lead to additional time and money spent on accounting services but could also be an opportunity to review a company's accounting systems at the same time.

Coulter told viewers of the Financial Services Council's online conference Regerations Reimagined that the costs of implementing the new standard would hit smaller insurers harder than larger organisations but would bring New Zealand into line with the rest of the world in terms of insurance accounting practices.

That is everyone except the United States, that has decided not to implement IFRS17 and will instead use its own standards.

NZ IFRS17 is the latest IFRS standard for insurance contracts and replaces NZ IFRS4 on January 1, 2022, however, the changes won't affect insurers until later that year depending on the timing of accounting dates.

It states which insurance contracts items should be on the balance and the profit and loss account of an insurance company, how to measure these items and how to present and disclose this information.

Coulter says NZ IFRS4 was supposed to be a temporary standard to make sure New Zealand was in a position to adopt an international standard but has stayed in place since 2001.

According to Deloitte New Zealand, IFRS17 will result in fundamental changes to the way organisations evaluate, account for and report on insurance contracts.

"The impact will be organisation-wide, affecting processes and systems and requiring greater coordination between business functions including finance, actuarial and IT."

The firm says costs will likely be higher for life insurers than for general insurers.

Coulter says legacy business will be affected as the transition will assume that NZ IFRS 17 has always been in place and could throw up some problems with long-term record keeping and even harder if mergers or acquisitions have occurred.

"Ongoing data collection can create a lot of work depending on how your systems are set up. These are often disjointed and manual uploads of data will be harder and you'll find the risk of human error is increased, so you may want to automate some of these processes."

| « Non-disclosure case highlights need for better records | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |