Partners Life profit flat on back of continued growth

Partners Life has reported a flat profit for the year to March 31, even though premium revenue has continued to grow.

Tuesday, August 1st 2017, 2:19PM

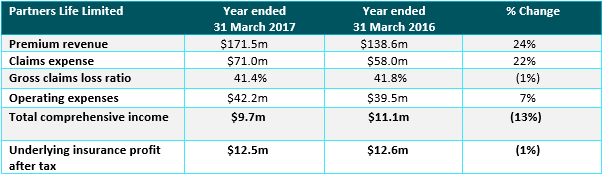

The company has reported underlying insurance profit of $12.46 million, slightly down on last year’s record $12.57m.

Chief financial officer Sean Kam described the previous year’s profit as “exceptional” and said this year’s, although flat, was still “good”.

Kam says the key difference in the results is due to changes in economic assumptions, based on rising interest rates.

He says last year’s record result was buoyed by significant positive claims experience relative to expectations. Claims experience in the current year was also positive, but not to the same extent.

He said because Partners was a young company with a relatively small book of business there would be volatility in its claims experience.

As the company matures the claims experience will be less volatile, he says.

“Overall the company was performing well with good growth rates, good claims experiences and lapses running at lower levels than average industry rates,” he says.

Premium revenue was up 23.68% to $171.5m; $41m of this was API from new business.

On the commission front Partners Life paid out $58.1m in upfront commissions compared to $57m in the previous year.

Kam says that doesn’t mean the company is paying lower commission to advisers.

Its “maintenance costs” which include trail commissions increased by $4.08m, which is a 30.36% increase to $17.28m.

Kam also said the company was efficient compared to its older competitors.

“We are 35% more efficient than the average in the market,” he says.

Partners also performed well in terms of lapses. Based on Financial Service Council figures Partners was running at around 10.8% compared to an industry average of 11.9%.

He says the peak lapse rate period was when policies had been on the book for three to four years. This is “when we are most exposed to replacement".

Partners didn’t issue any Shadow Shares in the most recent financial year, but it has restarted the scheme recently.

Shadow Shares are deferred cash commissions which are linked to the increase in the value of Partners Group Holdings share price, rather than actual shares in the company.

The size of the deferred commission pay-out is linked to the quality of each qualifying tranche of business, with significant pay-out enhancements for higher persistency outcomes.

At March 31, 2016 shadow shares were valued at $4 each and 12 months later the value was assessed at $4.25.

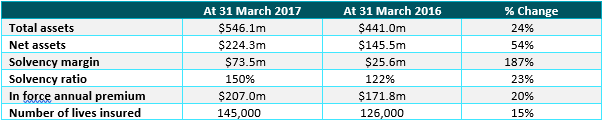

Partners Life managing director Naomi Ballantyne said there were a number of key milestones reached during the year.

"We achieved three significant $200m milestones; $207m of in-force premiums, $200m of claims paid since our inception in 2011, and a $200m capital commitment from the Blackstone Tactical Opportunities Fund.”

As in previous years, Partners Life measures its accounting performance based on its underlying insurance profit rather than comprehensive income, which is influenced by fluctuations in economic assumptions (e.g. market interest rate or inflation movements) which are beyond the company’s control.

Partners Life’s core underlying insurance profit was $12.5m, in line with last year’s record result which was buoyed by significant positive claims experience relative to expectations. Claims experience in the current year was also positive, but not to the same extent.

The first tranche of Blackstone’s capital was received in September 2016, and has strengthened Partners Life’s financial position, with total assets up 24% to $546m, and in a solvency margin of $73.5m, 150% of the minimum required by regulator the Reserve Bank.

| « EDRs: Here's how to protect yourself from churn claims | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |