New Zealand death rates low, despite Covid-19

Actuary firm provides interesting data around the death rates, but this doesn’t seem to be affecting claims . . . yet

Thursday, November 12th 2020, 4:17PM

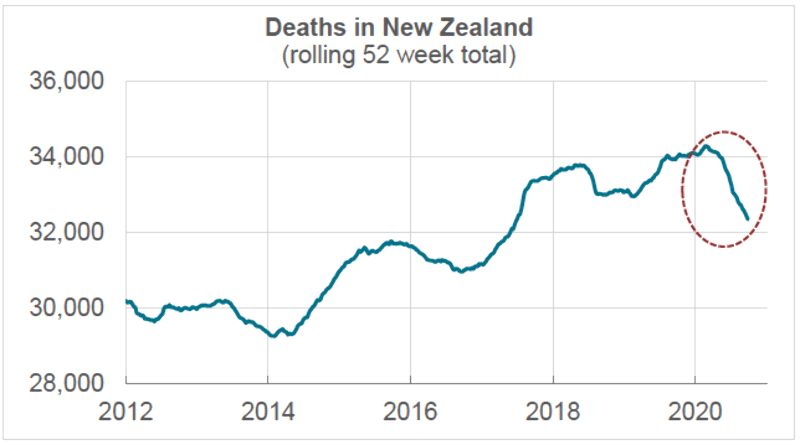

A report from consulting actuary firm Melville Jessup Weaver has revealed that at the end of September 2020, fewer people had died in New Zealand than in any time since 2017. This is particularly significant given Covid-19 and an increasing population.

While there is no way of knowing the reasons for this decrease, it seems likely that lockdown prevented people from being exposed to many infectious diseases that can lead to death in vulnerable populations.

Jeremy Holmes, partner at Melville Jessup Weaver, says this downwards trend could have implications for life insurers.

“There are two ways to view the lower mortality this year: a permanent improvement in mortality, or a short-term improvement in mortality.

“If it’s the latter, then that would suggest there might be some sort of catchup in mortality in future years. The real answer might be some combination of [both]: this could have implications for life insurers.”

Unsurprisingly, when broken down by age, those aged 80 or over make up the majority of deaths. Holmes believes this could affect services across the board.

“The reduced mortality this year has implications for much more than just insurers. If the elderly are living longer then this has implications for private superannuation plans, NZ super, retirement homes.”

So far, this reduction deaths isn’t hitting life insurers. When approached for comment Cigna stated that there has been little change in the claims rates year-one-year.

“While claims naturally vary year upon year, Cigna has not seen any significant variance in its claims over the past 12 months compared to previous years,” says chief executive officer Gail Costa.

The report was compiled from Statistics New Zealand, Ministry of Health and Ministry of Transport data.

| « Southern Cross/ProCare partnership opens up virtual GP service | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |